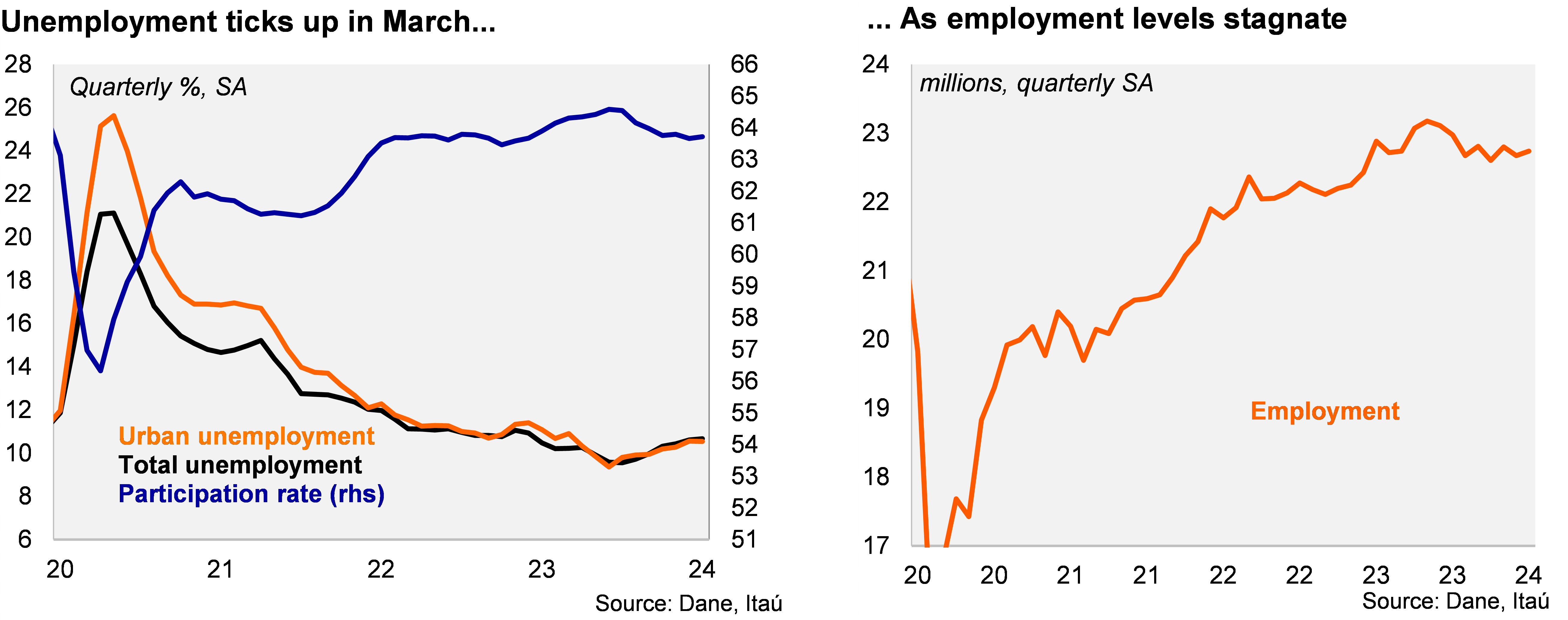

The unemployment rate is gradually trending up, as employment levels stagnate. The national unemployment rate reached 11.3%, up by 1.3pp over one year, while the urban unemployment rate came in at 10.8% in March (a rise of 0.3pp over one year), below both the Bloomberg market consensus and our call of 11.1%. Employment contracted by 0.7% YoY in March (+1.2% previously), while the labor force rose by 0.8% (1.5% in February). The participation rate fell by 0.4pp from March last year to 63.9%. At the margin, total employment increased by 0.3% MoM/SA from February, only partly unwinding the previous 0.6% drop, resulting in employment remaining broadly flat between 4Q23 and 1Q24 (+0.2%). As a result, the unemployment rate during 1Q24 was 10.7% (+0.2pp over one year), while increasing by 0.4pp (SA) from 4Q23.

Growth of private salaried posts slows. During 1Q24, employment increased by 1.0% YoY, decelerating from the 2.3% in 4Q23. The annual increase was pulled up by private salaried posts (+2.6% YoY; 3.2% in 4Q23). On the other hand, public sector jobs fell by 3.4% (-0.8% in 4Q23), and self-employment fell by 1.3% (+2.5% in 4Q23). Real estate, financial and insurance activities and manufacturing were key job drivers in the 1Q24, while communications and hotels shed jobs.

Our Take: We expect the unemployment rate to average 10.6% this year, somewhat above the 10.2% average of 2023 (11.2% in 2022). Weak economic activity, amid high interest rates and a still elevated inflation, support our view for labor market weakness.

Andrés Pérez M.

Vittorio Peretti

Carolina Monzón

Juan Robayo