2025/10/31 | Julia Passabom & Mariana Ramirez

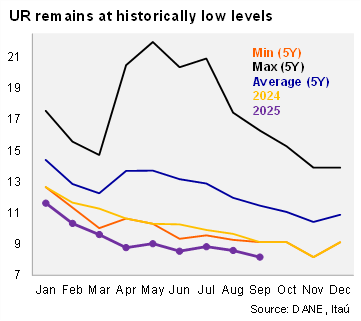

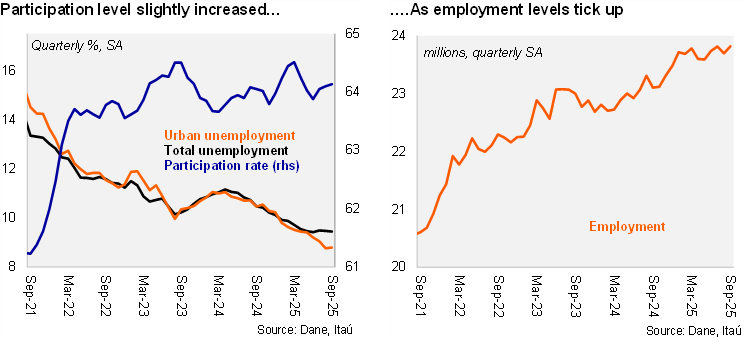

Employment increased sequentially, while the unemployment rate remained at historically low levels. According to DANE’s September labor market data, the national unemployment rate fell to 8.2%, down by 1.0pp over one year, while the urban unemployment rate was 8.1% in September (dropping 1.0pp over one year). The urban unemployment rate was above the Bloomberg market consensus of 7.7% and our 7.5% call. Total employment increased 3.1% YoY in September (+1.7% in August), while the labor force rose by 2.0% (+0.5% previously). The participation rate increased by 0.4pp from September 2024 to 63.9%, but remained below the level observed in the pre-pandemic period (64.8% average in 2019). The national unemployment rate (SA) fell to 8.8% (9.0% in the previous month), while the urban unemployment rate (SA) increased to 8.5% (8.1% in August; BanRep’s NAIRU: 10.2%). In 3Q25, the seasonally adjusted unemployment rate remained stable from 2Q25 at 8.9%. Sequentially, employment rose by 0.5% MoM from August to September, and increased 0.6% between 2Q25 and 3Q25.

Private salaried posts and self-employment were the main job creators in 3Q25. During 3Q25, employment grew by 2.7% YoY (+3.1% in the 2Q25). The annual increase was pulled up by private salaried posts (+5.5% in 3Q25; +2.7% in 2Q25), while self-employment increased by +1.4% YoY (+5.7% in 2Q25). On the other hand, public sector jobs fell by 4.8% (-0.8% in 2Q25). Financial and insurance activities, hotels and restaurants, construction and manufacturing were key job drivers in 3Q25.

Our take: The labor market continues to show resilience, which, combined with high inflation, and risks of another large minimum wage hike, pose challenges to the disinflation process. We forecast an unemployment rate of 9.0% in 2025.