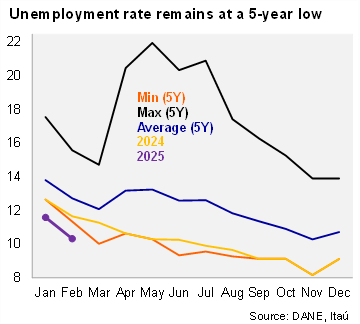

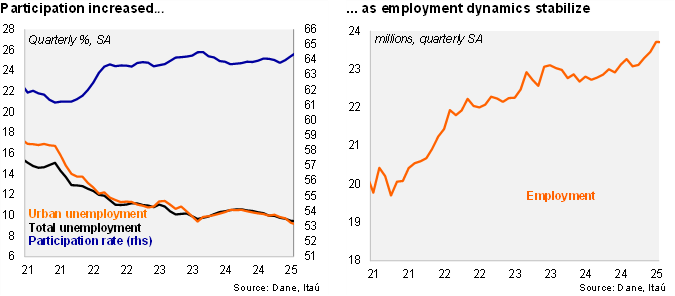

National unemployment rate close to a single digit. The urban unemployment rate fell to 9.8%, a drop of 1.8pp from February 2024, below the Bloomberg market consensus of 10.2% and slightly below our 10% call. The national unemployment rate reached 10.3% in February, down 1.3pp over one year. Employment increased +4.3% yoy in February (+4.0% in January), while the labor force rose 2.8% (similar to the previous month). The participation rate increased 0.9pp over one year to 64.7%. Sequentially, employment remained broadly stable from January (+1.1% previously), while the unemployment rate (SA) dropped by a mild 0.1pp from January to 9.3%, and the urban unemployment rate remained stable at 9.0% (well below BanRep’s NAIRU estimate of 10.5%).

Self-employment and private salaried posts were the main job creators, again. In the quarter ending in February, employment increased 3.9% yoy (+2.2% in 4Q24), supported by self-employment increase of 7.0% (+1.9% in 4Q24), an increase of 3.0% of private salaried posts (+2.7% in 4Q24), while public sector jobs fell 2.8% over the last year (+1.9% in 4Q24). Real estate, public administration and commerce were key job drivers on an annual basis.

Our Take: We expect the average unemployment rate to remain stable this year at 10.2%, but with a downside bias, given the improved performance of key sectors such as commerce, boosted by favorable internal demand dynamics.