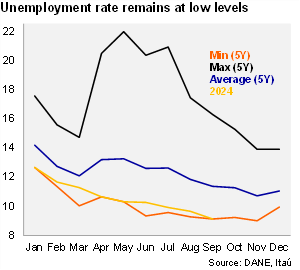

The unemployment rate fell sequentially, but employment dropped at the margin. According to DANE’s September labor market survey, the national unemployment rate fell to 9.1%, down 0.1pp over one year, while the urban unemployment rate fell to 9.2% in September (dropping 0.5pp over one year). The urban unemployment rate was below the Bloomberg market consensus and our call of 9.8%. National employment increased 0.3% yoy in September (+1.5% in August), while labor force rose by 0.5% yoy (+1.1% previously). The participation rate fell by 0.7pp from September 2023 to 63.5%. In the 3Q, the unemployment rate (SA) fell to 10%, down 0.4pp from 2Q24 (+0.2pp over one year). Sequentially, employment fell 0.8% MoM/SA from August, but rose 1.0% between 2Q24 and 3Q24. The unemployment rate (SA) remains below the NAIRU rate of 11.2% (SA), indicating that labor market continues to generate inflationary pressures.

Private salaried posts continued to be the main job creator. During 3Q24, employment growth increased to 0.6% yoy, slightly below from the 0.7% in 2Q24. The annual increase was pulled up by private salaried posts (+2.1% yoy; +2.8% in 2Q24). On the other hand, public sector jobs fell by 5.2% (-2.3% in 2Q24), and self-employment fell by 0.3% (-2.5% in 2Q24). Hotels, restaurants and professional activities were key job drivers in the 3Q24, while construction, finance and insurance activities, transport and real state shed jobs.

Our take: We expect the unemployment rate to average 10.6% this year, somewhat above the 10.2% average of 2023 (11.2% in 2022). Although activity has shown greater resilience than expected, key sectors for job creation such as construction and manufacturing continue to show signs of weakness, which supports our view for growing labor market slack.