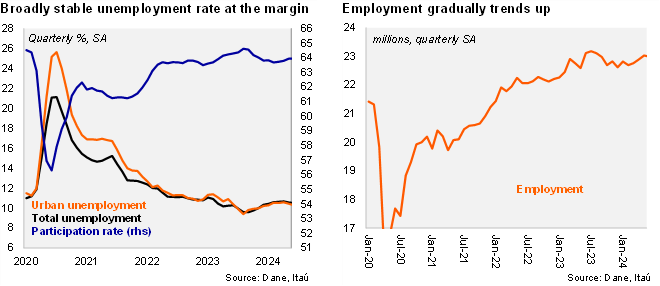

The unemployment rate fell sequentially. According to the DANE’s June labor market survey, the unemployment rate (SA) during 2Q24 fell to 10.5%, down 0.1pp from 1Q24 (+0.2pp over one year). Sequentially, employment fell 0.2% MoM/SA from May, but rose 0.9% between 1Q24 and 2Q24. On an annual basis, the national unemployment rate increased to 10.3%, up 0.9pp over one year, while the urban unemployment rate reached 10.2% in June (increasing 1.4pp over one year). The urban unemployment rate was somewhat below the Bloomberg market consensus of 10.4%, and our call of 10.3%. Employment contracted 0.6% YoY in June (+2.1% in May), while the labor force rose by 0.5% YoY (+1.9% previously). The participation rate fell by 0.6pp from June 2023 to 63.7%.

Private salaried posts continued to be the main job creator. During 2Q24, employment growth fell to 0.7% YoY, down from the 1.0% in 1Q24. The annual increase was pulled up by private salaried posts (+2.8% YoY; +2.6% in 1Q24). On the other hand, public sector jobs fell by 2.3% (-3.4% in 1Q24), and self-employment fell by 2.5% (-1.3% in 1Q24). Real estate, hotels, communications were key job drivers in the 2Q24, while commerce, transportation and agriculture shed jobs.

Our take: We expect the unemployment rate to average 10.6% this year, somewhat above the 10.2% average of 2023 (11.2% in 2022). Although activity has shown greater resilience than expected, key sectors for job creation such as construction, manufacturing and commerce continue to show signs of weakness, which supports our view for growing labor market slack.

Andrés Pérez M.

Vittorio Peretti

Carolina Monzón

Juan Robayo