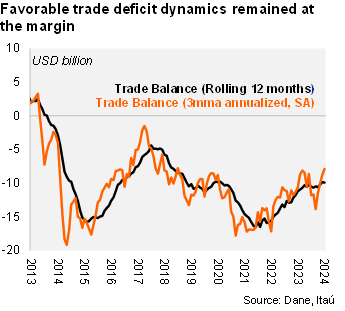

The trade deficit in October came in at USD 1.1 billion, widening by USD 0.1 billion with respect to October 2023. The trade deficit was slightly above the Bloomberg market consensus of USD 1.0 billion and our USD 0.9 billion call. Total imports (FOB) rose by 4.9% (+2.5% in September), boosted by imports of agricultural products, food and beverages. Meanwhile, exports increased 3.8% yoy in October (-0.2% in the previous month), lifted by coffee and non-traditional exports. As a result, the rolling 12-month trade deficit sits at USD 9.9 billion (USD 9.7 billion in 2023; USD 14.5 billion in 2022). At the margin, our seasonal adjustment shows the trade deficit at USD 7.9 billion (annualized), down from the USD 8.8 billion recorded in 3Q24.

Last quarter of the year starts with an improvement in import dynamics. The 4.9% yoy increase was boosted by consumption goods (+16.9% yoy), mainly durable consumption goods (+32.5% yoy), goods for industry (+15.1% yoy) and capital goods for agriculture (+11.6% yoy). In the quarter ending in October, imports increased 3.5% yoy (+5.6% in 3Q24). Imports excluding fuels and transportation equipment rose from last year 10.2% yoy (+12% yoy in 3Q24; +6.4% yoy in 2Q24). At the margin, we estimate imports fell 3.2% qoq/saar (-16.4% in 3Q24; +47.6% in 2Q24).

Commodity exports contracted on an annual basis. Exports increased by 3.8% yoy (-0.2% in September). Coffee posted a large 82% YoY increase, partially offsetting the 25% YoY and 20% YoY declines in coal and oil exports, respectively, amid negative price effects. Overall, oil, coal, coffee and ferronickel accounted for 47% of total exports (but declined 3.5% YoY). Non-traditional goods expanded by 26.9% YoY. In the quarter ending October, exports increased 0.4% yoy (+2.8% in 3Q24; +3.8% YoY drop in 2Q24). At the margin, exports grew by 28.5% qoq/saar (20.6% in 3Q24; +4.8% in 2Q24).

Our take: The gradual domestic demand recovery, and weak commodities exports have led to a mild widening of the trade deficit. Nevertheless, amid higher remittances and weak COP dynamics, we now expect the current account deficit to narrow to 2.0% of GDP this year (2.5% previously expected), and some widening for 2025 to 2.8% of GDP.