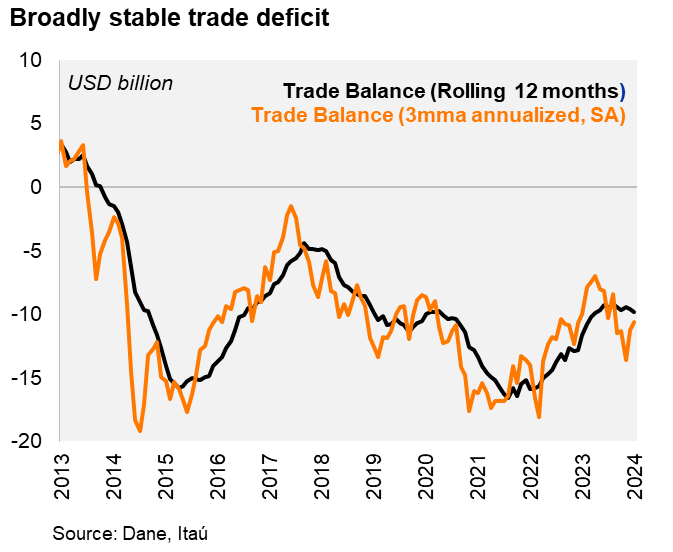

The trade deficit in August came in at USD 1.3 billion, widening by USD 0.2 billion with respect of August 2023. The trade deficit was slightly above the Bloomberg market consensus and our call USD 1.2 billion. Total imports (FOB) rose by 3.0% yoy (+11.5% yoy in July), boosted by fuels and manufacturing goods, but partially countered by agricultural goods. Meanwhile, exports fell by 2.5% yoy in August (+10.9% yoy in July), dragged by commodities exports. As a result, the rolling 12-month trade deficit sits at USD 9.6 billion (USD 9.7 billion in 2023, USD 14.5 billion in 2022). At the margin, our seasonal adjustment shows the trade deficit at USD 10.6 billion (annualized), down from the USD 13.6 billion recorded in 2Q24.

Imports fell sequentially in August. The 3.0% yoy increase was boosted by construction materials (42.2% yoy), capital goods for industry (7.0% yoy) and consumption goods (5.0% yoy). In the quarter ending in August, imports rose by 2.4% yoy (+4.4% in 2Q24; -10.9% in 1Q24). Imports excluding fuels and transportation equipment increased from last year at 8.0% (+6.4% in 2Q24; -7.7% yoy in 1Q24). At the margin, we estimate imports fell by 7.5% qoq/saar (+47.7% in 2Q24; -12.8% in 1Q24).

Commodities dragged exports down in August. Exports contracted by 2.5% yoy (+10.8% in July). Oil exports dropped 10.1% YoY (-6.4% YoY in July), due to lower prices. Meanwhile, after a favorable dynamic in July, coal exports returned to negative territory, contracting by 27.1% YoY (+30.4% in July), due to lower prices and volumes. As a result, exports excluding traditional goods (oil, coal, coffee, and ferronickel), accounted for the 47.7% of the total exports, rising by 5.2% YoY. In the quarter ending August, exports increased 1.3% YoY (+3.4% in 2Q24; 9.2% YoY drop in 1Q24), boosted by increases in coffee, manufacturing and agricultural exports, but countered by double-digit declines in coal exports. At the margin, exports fell by 3.6% qoq/saar (+5.4% in 2Q24; -17.4% in 1Q24).

Our Take: A still contractionary monetary policy should keep domestic demand soft and support a gradual narrowing of the trade deficit. Alongside higher remittances, we expect the current account deficit to remain stable from last year at 2.5% of GDP.

Vittorio Peretti

Carolina Monzón

Juan Robayo

Angela Gonzalez