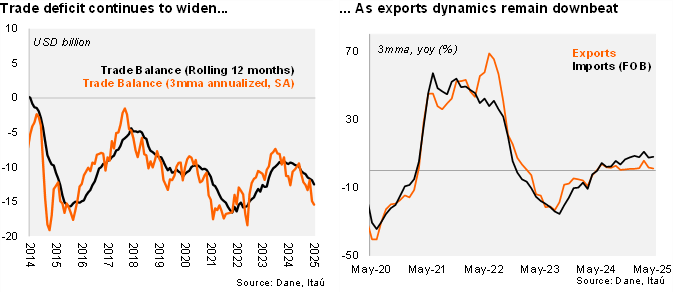

The trade deficit in May rose to USD 1.4 billion, widening by USD 0.7 billion with respect to May 2024, slightly above consensus (USD1.3 billion). Total imports (FOB) increased by 10.7% YoY (-1.0% in April), boosted by manufacturing and agricultural goods, but countered by fuels. Meanwhile, exports contracted by 2.1% YoY (-6.6% YoY in April), still dragged by coal and oil exports. As a result, the 12-month rolling trade deficit sits at USD 12.6 billion (USD 10.8 billion in 2024; USD 9.7 billion in 2023).

Imports remain upbeat. The 10.7% YoY increase was boosted by consumption goods (+20.5% YoY), capital goods (+9.9% YoY) and raw materials and intermediate goods (+6.8% YoY). In the rolling quarter ending in May, imports increased 8.0% YoY (+11% in 1Q25). Imports excluding fuels and transportation equipment rose by 9.0% YoY from May last year. At the margin, we estimate imports grew roughly 13.4% qoq/saar (-17.9% in 1Q25). As of May, imports from the US accounted for 25% of the total.

Weak exports persisted in May. Exports fell by 2.1% YoY (-6.6% YoY in April). Coffee exports continued to perform well, rising 61% YoY (+86.8% YoY in April). Nevertheless, energy exports remained downbeat, with oil exports falling 24.8% YoY (-31.4% YoY in the previous month), while coal exports dropped 13.4% YoY (-37.5% YoY in April). Meanwhile, non-traditional exports posted a 10.7% YoY expansion (+8.5% YoY in April). In the quarter ending April, exports increased 1.2% YoY (+5.8% YoY in 1Q25). At the margin, exports contracted 7.9% qoq/saar (+12.3% in 1Q25). As of May, exports to the US accounted for 29.8% of the total.

Our Take: Stronger domestic demand is driving a rebound in imports, while commodity-related weakness continues to weigh on exports. We forecast a gradual widening of the CAD to 2.6% of GDP in 2025 (from 1.8% in 2024).