2025/09/22 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

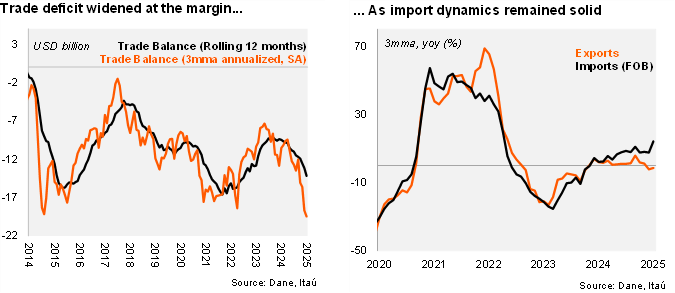

The trade deficit rose to USD 1.7 billion in July, widening by USD 1.1 billion compared to July 2024, and exceeding both the Bloomberg market consensus of USD 1.6 billion and our forecast of USD 1.2 billion. Total imports (FOB) increased by 16.9% YoY (+14.8% in June), driven by agricultural, fuel, and manufacturing imports. Meanwhile, exports contracted by 4.1% YoY (+2.6% in June), still weighed down by coal and oil exports. As a result, the 12-month rolling trade deficit stands at USD 14.2 billion (USD 10.8 billion in July 2024; USD 9.7 billion in 2023).

Import growth remains solid. The 16.9% YoY increase was boosted by agricultural imports (+67.9% YoY, 2.5pp contribution), consumer goods (+30.1% YoY, 7.6pp) and intermediate goods for industry (+24.6% YoY, 7.8pp). In contrast, capital import goods posted a 3.5% YoY contraction (-1.1pp) led by transport equipment (-14.2% YoY, -1pp) and capital imports for industry (-3% YoY, -0.6% pp). In the rolling quarter ending July, imports increased 14.1% YoY (+7.6% in 2Q25). Imports excluding fuels and transportation equipment rose by 19% from July last year. At the margin, we estimate imports grew by 25.2% qoq/saar (+28.6% in 2Q25).

Weak export trend persists in July, dragged by energy goods. Exports fell by 4.1% YoY. Coffee exports remain upbeat, growing by 70.3% YoY (+46.4% in June). However, energy exports continue to be a notable drag: coal exports contracted by 45.8% (-15.2% in the previous month), while oil exports declined by 17.1% YoY (-18% in June) due to lower prices and volumes. Non-traditional exports posted a solid 12.6% YoY expansion (+15.1% in June). In the quarter ending July, exports fell 1.4% YoY (-2.1% in 2Q25). At the margin, exports contracted 5.4% QoQ/saar. As of July, exports accounted for 30.6% of the total.

Our Take: The strengthening of domestic demand is fueling a recovery in imports, while ongoing weakness in commodity-related sectors continues to drag exports. We anticipate a widening of the current account deficit to 2.8% of GDP in 2025, up from 1.8% in 2024.