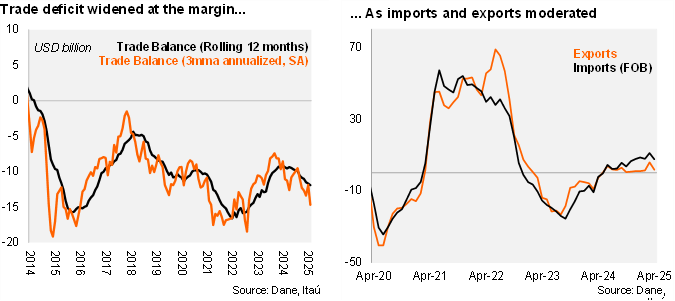

The trade deficit In April came in at USD 1.4 billion, widening by USD 0.2 billion with respect to April 2024. The trade deficit was in line with the Bloomberg market consensus, but above our call of USD 1.2 billion. Total imports (FOB) fell by 1.0% (+15.9% in March), dragged by manufacturing and fuels. Meanwhile, exports fell 6.5% YoY (+13.7% YoY in March), still dragged by oil and coal exports. As a result, the 12-month rolling trade deficit sits at USD 11.9 billion (USD 10.8 billion in 2024; USD 9.7 billion in 2023).

Imports increased sequentially in April. The 1.0% YoY contraction was dragged by transport equipment (-15.6% YoY), raw materials for industry (-4.4% YoY) and non-durable consumption (-2.9% YoY). In the rolling quarter ending April, imports increased 7.6% YoY (+11% in 1Q25). Imports excluding fuels and transportation equipment rose by 9.9% from April last year. At the margin, we estimate imports grew at around 28.9% qoq/saar (-17.9% in 1Q25). As of April, imports from the US accounted for 25% of the total.

Exports returned to negative territory in April. Exports fell by 6.5% YoY (+13.7%YoY in March). While Coffee exports continued to post a strong performance with a 86.8% YoY increase (137 YoY in March), the contraction of other traditional exports explained the negative outcome. Precisely oil and coal exports fell -31.2% YoY and -37.5% YoY during the month due to both falling volumes and prices. Meanwhile, non-traditional exports posted a 8.5% YoY expansion (23% YoY in March). In the quarter ending April, exports decreased 29.1% yoy (+12.3% in 1Q25). At the margin, exports contracted 29.1% qoq/saar (+12.3% in 1Q25). As of April, exports to the US accounted for 31% of the total.

Our Take: While imports moderated in April, commodity prices continue to drag exports. We expect a gradual widening of the CAD this year to 2.6% (1.8% of GDP in 2024).