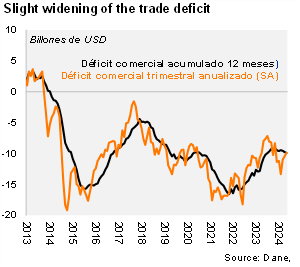

The trade deficit came in at USD 0.7 billion in September, widening USD 0.2 billion over one year. The deficit was slightly below the Bloomberg market consensus and our USD 0.8 billion call. During 3Q24, the trade deficit reached USD 2.6 billion, up from USD 2.1 billion in 3Q23. As a result, the rolling 12-month trade deficit reached USD 9.8 billion (USD 9.3 billion as of June; USD 9.7 billion in 2023). At the margin, our seasonal adjustment shows the trade deficit at USD 9.9 billion (annualized), down from the USD 13.4 billion high in 2Q24.

Imports fell sequentially in 3Q24. During 3Q24, imports increased by 5.6% yoy (+4.4% yoy in 2Q24). Construction materials (+28.9% yoy), capital goods for industry (+16.9% yoy) and consumption goods (+13.9% yoy) boosted the 3Q24 print, but it was partially countered by transport equipment (-26.0% yoy) and capital goods for agriculture (-4.6% yoy). Imports excluding fuels and transportation equipment rose by 12% yoy (+6.4% yoy in 2Q24). At the margin, we estimate that imports fell by 17.6% qoq/saar (+47.6% in 2Q24), dragged by non-durable goods (-23.7% qoq/saar) and consumption goods (-11.9% qoq/saar).

Non-traditional exports rebounded. During 3Q24, exports increased 2.6% yoy (+3.8% in 2Q24), boosted by increases in coffee (+29.9%), agro-industrial exports (+16.5%) and ferronickel (+15.4% yoy), but partly offset by weak oil (-13.5%) and coal (-2.2% yoy). Exports excluding traditional goods (oil, coal, coffee, and ferronickel), accounting for 47.7% of total exports, increased by 13.8% yoy. At the margin, exports increased 4.3% qoq/saar (+6.4% in 2Q24).

Our Take: The gradual recovery of domestic demand, and weak oil exports have led to a sustained trade deficit. Nevertheless, we expect the current account deficit to remain low at 2.5% of GDP (2.7% of GDP in 2023), amid upbeat transfers.