2025/08/19 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

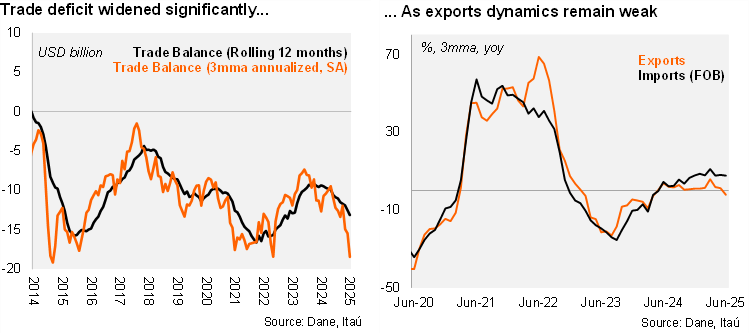

The trade deficit came in at USD 1.1 billion in June, widening USD 0.6 billion over one year, in line with the Bloomberg market consensus of USD 1.1 billion and slightly below our USD 1.2 billion call. During 2Q25, the trade deficit reached USD 3.9 billion (USD 3.4 billion in 1Q25). As a result, the rolling 12-month trade deficit reached USD 13.1 billion, above from the USD 10.8 billion deficit recorded in 2024 (USD 9.7 billion in 2023). In June, total imports (FOB) increased by 14.8% YoY (+10.7% in May), boosted by manufacturing and agro-industrial imports, while exports rose 2.6% YoY in June (-2.1% in May), lifted by coffee exports but dragged by commodities. At the margin, our seasonal adjustment shows the trade deficit in the quarter set at USD 18.5 billion (annualized; USD 11.9 billion in 1Q25).

Imports increased at a double-digit rate in 2Q25. During 2Q25, imports increased by 7.6% YoY (+11.0% YoY in 1Q25). Consumption goods (+15.8% YoY), with durable consumption goods growing 27.1% YoY; construction materials (+10.6% YoY) and materials goods for agriculture (+10.7% YoY) boosted the print. Imports excluding fuels and transportation equipment rose by 6.6% YoY (+13.5% YoY in 1Q25). Excluding transportation goods, imports posted a 5.4% YoY expansion (14.2% in 1Q25). Nevertheless, at the margin, we estimate that imports increased 26.1% QoQ/saar (-2.1% in 1Q24). During 2Q25, imports from the US accounted for 24.6% of the total (24.6% in 2024).

Exports fell at the margin in the 2Q, dragged by commodities. During 2Q25, exports fell 2.2% YoY (+5.8% YoY in 1Q25). Coffee (+64% YoY) led the increase in agricultural exports (+36% YoY), while non-traditional exports grew by +11% YoY. Nevertheless, exports gains were contained by a large decline in oil exports (-24.8% YoY) and coal exports (-22.8% YoY). At the margin, exports fell by 20% YoY QoQ/saar during the second quarter of the year (-0.5% in 1Q25). As of June, the US accounted for 30.4% of total exports (29% in 2024).

Our Take: Stronger domestic demand and in particular private consumption demand of durable goods is fueling a recovery in imports, while continued weakness in commodity exports is weighing on overall trade performance. We expect the current account deficit to gradually widen to 2.7% of GDP in 2025, up from 1.8% in 2024 despite the good performance of remittances.