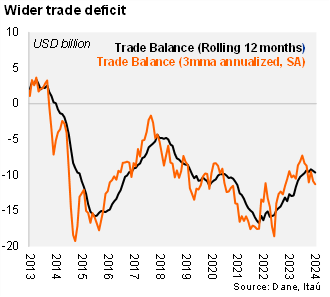

The trade deficit in May rose to USD 0.8 billion, increasing by USD 0.2 billion with respect to May 2023. The trade deficit was slightly above the Bloomberg market consensus of USD 0.7 billion and our USD 0.6 billion call. Total imports (FOB) increased by 2.2% YoY (+18.7% in April), boosted by fuels and manufacturing imports, but partially countered by agro-industrial imports. Meanwhile, exports fell by 1.1% in May (+17.9% in April), dragged by coal exports. As a result, the rolling 12-month trade deficit sits at USD 9.5 billion (USD 9.7 billion in 2023; USD 14.5 billion in 2022). At the margin, our seasonal adjustment shows the trade deficit at USD 11.3 billion (annualized), up from the USD 8.5 billion recorded in 1Q24.

Consumer goods imports picked-up, while investment related imports remained weak. The 2.2% YoY increase was boosted by manufactured goods (9.1% YoY), fuels (8.1% YoY), and consumption goods (+7.2% YoY), but partially countered by transport equipment (-24.3% YoY), construction materials (-20.1% YoY) and agriculture related goods (-14.9% YoY). In the quarter ending in May, imports contracted 0.3% YoY (-10.9% in 1Q24; -10.4% in 4Q23). Imports excluding fuels and transportation equipment were stable from last year (-7.7% in 1Q24; -12.5% in 4Q23). At the margin, we estimate imports increased 5.5% qoq/saar (-12.4% in 1Q24).

Coal drags exports in May. Exports contracted by 1.1% (+17.9% in April). Oil exports increased 18.4% YoY (+6.3% in April), due to higher prices and volumes. On the other hand, coal exports fell 30.2% (+19% YoY in April), mainly due to a decline in prices. Exports excluding traditional goods (oil, coal, coffee, and ferronickel), accounting for 46.7% of total exports, increased 0.3% YoY. In the quarter ending in May, exports increased 0.2% YoY (9.2% drop in 1Q24), dragged by double-digit declines in coal and ferronickel. At the margin, exports fell by 0.8% qoq/saar (-17.8% in 1Q24; +17.6% in 4Q23).

Our take: We expect the current account deficit to increase modestly this year to 3.0%, from 2.7% in 2023, consistent with the recent widening of the trade deficit.