2026/01/22 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

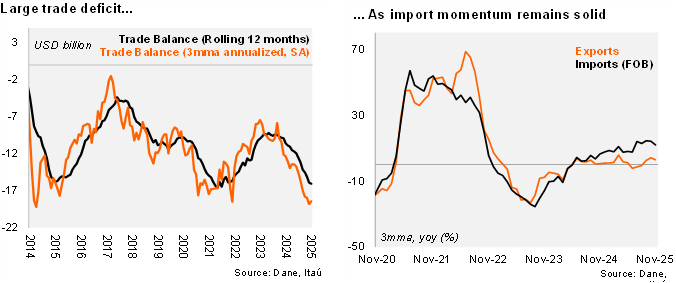

The trade deficit rose to USD 1.6 billion in November, up by USD 0.2 billion compared to November 2024, in line with the Bloomberg market consensus, but below our USD 1.9 billion call. Total imports (FOB) increased by 1.2% YoY (lower than the previous month’s +15.8% YoY), driven by consumption imports, agro-industrial and manufacturing imports, but contained by fuels and other intermediate imports. Meanwhile, exports fell 2.7% YoY (-0.2% YoY in October). As a result, the 12-month rolling trade deficit stands at USD 16.0 billion (USD 10.8 billion in 2024), the largest deficit since 2022.

Import growth remains solid at the margin. The 1.2% YoY increase was boosted by consumption goods (+19.6% YoY), with strong growth in durable consumption goods (+23.5% YoY), capital goods for agriculture (+9.3% YoY), and capital goods for industry (+7.0% YoY). In the rolling quarter ending in November, imports increased 12% (+14.6% in 3Q25). Imports excluding fuels and transportation equipment rose by 14.1% from November last year. At the margin, we estimate imports grew 12.2% QoQ saar (+12.4% in 3Q25). As of November, imports from the US accounted for 23% of the total (25.7% in 2024).

Despite the commodity drag, exports increased at the margin. Exports fell by 2.7% YoY, after a mild contraction of 0.2% YoY in October. Traditional exports led the outcome, declining by 11.9% YoY, amid an oil drop of 16.4% and a coal plunge of 47.4%. Non-traditional and coffee exports rose by 7.8% YoY and 84.7%, respectively. In the quarter ending November, exports increased 3.0% YoY (+2.6% in 3Q25). At the margin, exports increased 20.4% QoQ saar (+23.9% in 3Q25). As of November, exports to the US accounted for 29.5% of the total.

Our View: Robust domestic demand continues to drive import dynamics, while sustained weakness in oil prices drags exports. We expect the current account deficit to rise to 2.5% of GDP in 2025, up from 1.8% in 2024.