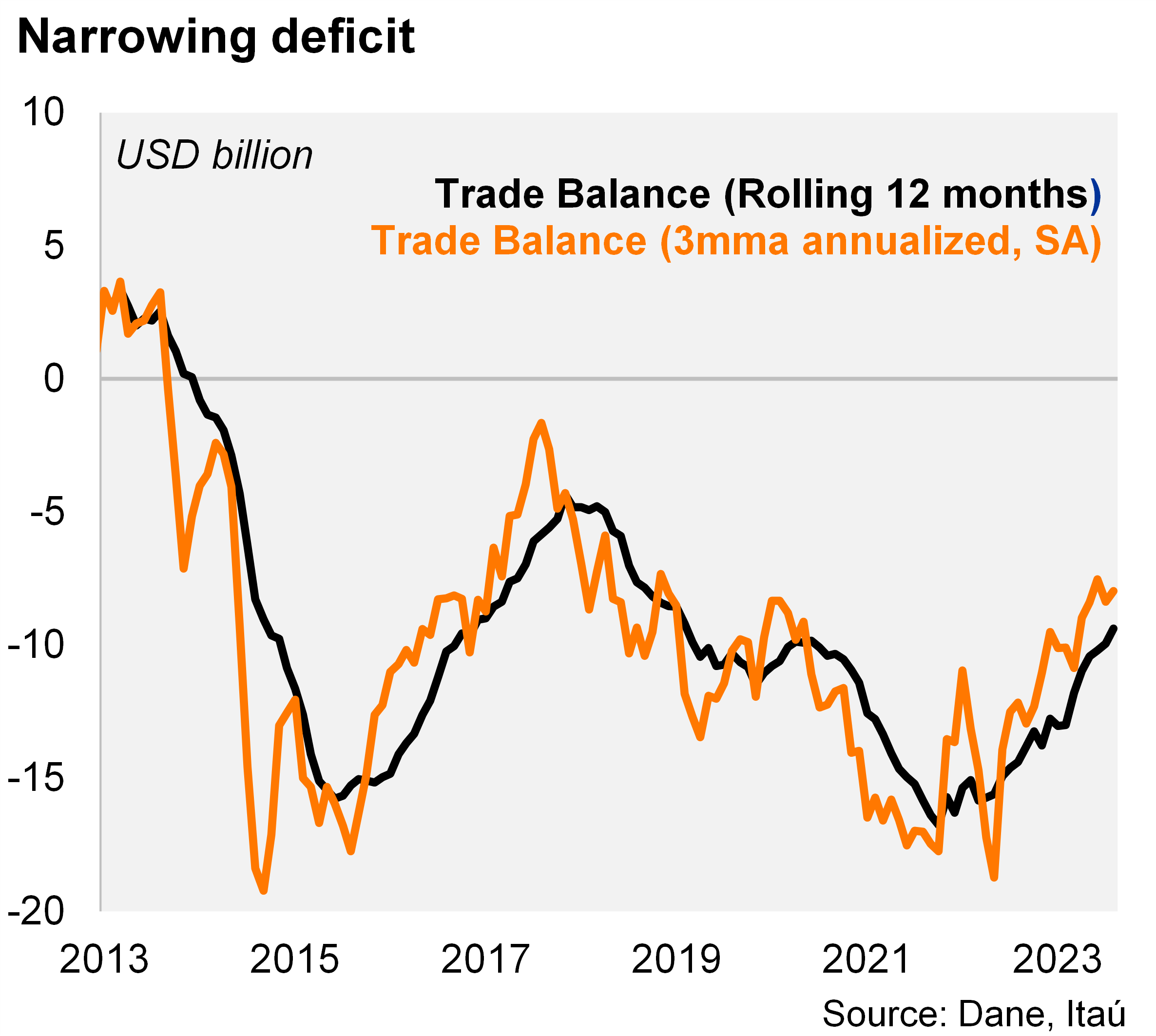

The trade deficit in January came in at USD 1.0 billion, narrowing USD 0.5 billion over one year. The deficit was slightly above the Bloomberg market consensus and our call of USD 0.9 billion. Total imports (FOB) contracted 9.1% YoY (8.1% in December) dragged mainly by fuels and agro-industrial goods. Exports grew a mild 1.3% YoY in January (-4.2% YoY in December), hampered by coal exports. As a result, the rolling 12-month trade deficit reached USD 9.4 billion, narrowing from the USD 9.9 billion deficit recorded in 2023 (USD 14.5 billion in 2022). At the margin, our seasonal adjustment shows trade deficit at USD 7.9 billion (annualized), down from the USD 8.3 billion recorded in 4Q23.

Imports remained weak amid the domestic demand adjustment. The 9.1% YoY import contraction in January was dragged by fuels (-52.6%), durable consumption goods (-15.5%) and capital goods for agriculture (-11.9% YoY). In the quarter ending in January, imports contracted 10% YoY (-10.4% in 4Q23; -25.5% in 3Q23). Imports excluding fuels and transportation equipment fell 8.2% YoY (-12.5% in 4Q23; -25.6% in 3Q23). At the margin, we estimate that imports increased 3.7% qoq/saar (+13.2% in 4Q23; -20.9% in 3Q23).

Coal continued to drag exports in January. The 1.3% YoY export increase was pulled up by oil exports (+15.6% YoY; +10.5% in December), mainly due to higher prices and volumes. Coal exports continued to fall (-28.9% YoY; -28.1% in December), mainly due to a decline in prices. Exports excluding traditional goods (oil, coal, coffee, and ferronickel), accounting for 44.1% of total exports, increased 16.4% YoY. In the quarter ending in January, exports contracted 4.3% YoY (5.0% drop in 4Q; -19.1% YoY in 3Q), dragged by a double-digit decline of coal, ferronickel and coffee exports. At the margin, exports expanded 7.9% qoq/saar (+21.5% in 4Q; -17.1% in 3Q).

Weak domestic demand will support a moderate current-account deficit this year. We expect the CAD to reach 3.0% of GDP in 2023 (2.7% in 2023).