2025/09/16 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

Retail sales and manufacturing surprised to the upside in July. Retail sales rose by eye-popping 17.9% YoY in July (+10.1% in June), well above the Bloomberg market consensus of 11.4% YoY and our 9.8% call. Core retail sales (excluding fuels and vehicles) increased 0.9% MoM/SA, leading to a 13.2% YoY rise (+11.4% previously). Meanwhile, manufacturing increased by 3.2% MoM (-1.8 in the previous month), resulting in a 5.8% YoY increase (+2.0% in June), higher than the Bloomberg market consensus of +3.1% and our 3.4% call. As a result, we revised our estimate for July’s monthly activity indicator (ISE) up by 1pp to +2.8% YoY, driven by tertiary activities, mainly commerce and entertainment, but partially offset by mining and construction. The indicator is scheduled for release on September 18.

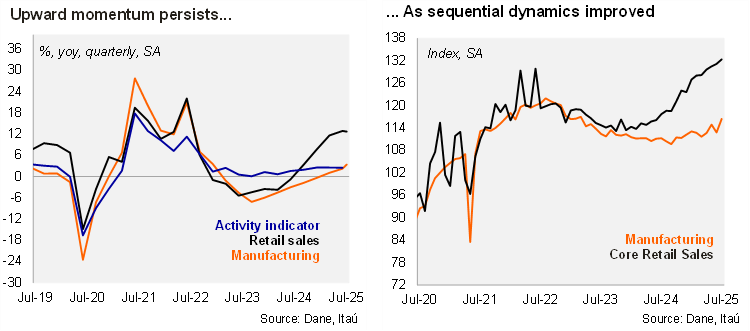

Activity is accelerating at the margin. During the quarter ending July, manufacturing increased by 3.7% YoY (+0.6% in the 2Q). At the margin, manufacturing increased by 8.6% qoq/saar, above the 3.5% in 2Q. During the quarter ending July, retail sales rose 13.8% YoY (+11.6% in 2Q), while core retail sales rose 13.1% YoY (+12.6% YoY in 2Q). Sequentially, core retail sales growth increased 8.7% QoQ/saar (from +8.8% QoQ/saar in 2Q25).

Our Take: Despite today's upside surprise, we have a downside bias to our 2.9% growth forecast for this year, given the weak performance of construction and mining sectors. Nevertheless, consumption continues to show favorable dynamics, and with the unemployment rate at historically low levels and CPI remaining above 5%, the bar is high for BanRep to cut interest rates in the short term.