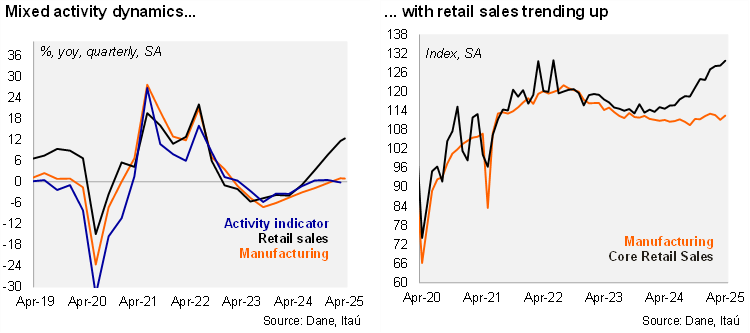

In annual terms, retail sales increased 11.4% in April (+12.7% in the previous month), above the Bloomberg market consensus of 8.4% and closer to our 11% call. Core retail sales (excluding fuels and vehicles), increased 1.2% from February (MoM/SA), leading to a 11.9% YoY increase (+11.7% in March). Retail sales were boosted by computer and telecommunication equipment and vehicle sales, but partially countered by fuels. Meanwhile, manufacturing increased by 1.2% MoM/SA, but still resulted in a 3.3% YoY contraction (+4.9% in March), larger than the Bloomberg market consensus of -0.8%, but broadly in line with our -3.4% call. Manufacturing was hindered by fewer working days during April due to the celebration of the Easter week during the month.

Core retail sales remain upbeat. During the quarter ending April, manufacturing growth was flat over one-year (+1.8% in 1Q25). At the margin, manufacturing fell by 0.6% qoq/saar, below the +2.1% in 1Q25. In contrast, during the quarter ending April, retail sales increased 10.6% (10.1% in 1Q25), while core retail sales rose by 10.5% (+10.1% in 1Q25). Sequentially, core retail sales increased 12.6% qoq/saar (from +16.5% in 1Q25), signaling an upbeat private consumption trend.

Our take: We expect the economy to grow 2.5% this year (above from the 1.7% in 2024), with private consumption remaining the main driver.