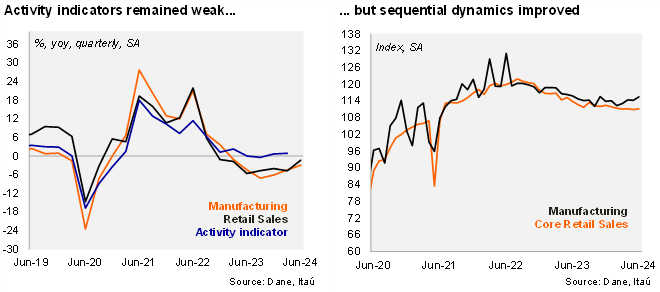

Retail sales and manufacturing increased sequentially in June but remained weak in 2Q. Retail sales increased by 1.5% YoY in June (-1.7% in May), above the Bloomberg market consensus and our +0.7% call. Core retail sales (excluding fuels and vehicles) increased 1.0% from May (MoM/SA), leading to a 1.1% YoY expansion (-1.7% YoY in May). Meanwhile, manufacturing increased 0.3% MoM/SA, leading to a 4.8% YoY decline (-3.5% previously), below the Bloomberg market consensus of -2.2%, and our -1.9% call. Retail sales and manufacturing dynamics underwhelmed in 2Q24, while agriculture, services and public administration have been more upbeat.

Manufacturing fell from 1Q24. Manufacturing contracted by 1.5% in 2Q24, after falling 6% in 1Q24. At the margin, manufacturing dropped 1.4% qoq/saar (-2.7% in 1Q24). Manufacturing levels are now 7.7% above pre-pandemic levels (down from a near 18% peak during 3Q22).

Core retail sales increased at the margin. During 2Q24, retail sales contracted 0.6% YoY (3.9% drop in 1Q24), while core retail sales dropped 1.3% (-2.8% in 1Q24). At the margin, core retail sales improved with growth of 5.5% qoq/saar (2.4% drop in 1Q24). Core retail sales now sit 11.4% above pre-pandemic levels (+27% by mid-2022).

Our take: We expect 2Q24 GDP, to be published on August 15, to rise by 2.7% YoY (0.7% in 1Q), boosted by agriculture, entertainment and public administration. With inflation dynamics still elevated, we expect BanRep to continue with the 50bp rate cut pace at the monetary policy meeting in September.