2026/02/05 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

The Financial Plan shows a decline in the nominal fiscal deficit to 5.3% of GDP and net public debt falling to 58.9% of GDP this year. Net public debt fell to 58.9% of GDP at the end of 2025, below the official forecast (61.4%) and the previous year (59.3%). The net debt decline was achieved through several measures that lowered interest payments from 4.7% of GDP in June to 2.9% of GDP by the end of 2025 and is projected to reach 3.1% of GDP for 2026. These figures point to a nominal fiscal deficit of ~6.6% of GDP at the end of 2025, in line with our estimates and below the official forecast of 7.1% (6.7% in 2024).

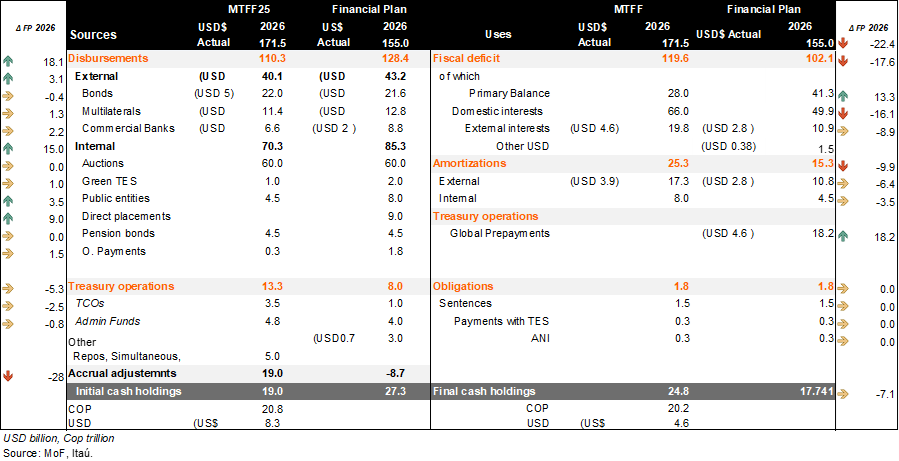

The 2026 nominal fiscal deficit is projected to decline, but the primary deficit will remain elevated. If approved by the Superior Council of Fiscal Policy (CONFIS), the 2026 fiscal deficit forecast would reach 5.3% of GDP. The central government’s gross financing needs are estimated at COP102 trillion (5.3% of GDP) in 2026, COP17.5 trillion lower than the previous official projections. Furthermore, the primary deficit, which stood at 3.3% of GDP in November last year, is expected to decrease to 2.1% by 2026, which is a less ambitious figure than that reported at the MTFF in June (1.4% of GDP). In doing so, the MoF aims to stabilize the net debt-to-GDP ratio at 58.9% in 2026.

The debt management strategy was focused on reducing interest payments. Interest payments in 2026 will amount to COP 60.7 trillion (60% of total financing; 76.4% in 2024) down by COP 16 trillion in comparison to the figure forecasted in the previous official forecast. Furthermore, 80% of the amount will be allocated to domestic payment. Overall, amortizations are projected to decline by COP 9.9 trillion to COP15 trillion. However, it is worth noting that 70% of the amount will be allocated to external debt.

Closure of the TRS and bond prepayment are main priorities. As a novelty, the MoF included treasury operations for COP18.1 trillion in global pre-payments (USD4,662 million) which accounts for 17.7% of the overall deficit. The TRS operation (USD 9.3 billion) will be fully paid before the end of the administration.

The 2026 financing strategy considers 66% local currency and 34% foreign currency (compared to the 63%/36% indicated in the MTFF). The total deficit is planned to be financed with COP43 trillion (USD9.8 billion) of external issuances, of which COP 21 trillion will be global bonds (USD 4.9 billion) already issued in early January). According to the Public Credit Director, 29% of external financing is expected through multilateral loans (USD 2.9 billion), while the remainder of USD 2.6 billion is to be raised through commercial loans with foreign banks (USD 4.3 billion in 2025).

Additional private placements are in the pipeline. Regarding internal issuances, the MoF plans COP 85.2 trillion, a figure COP 15 trillion higher than the MTFF estimates. While auctions remained stable at COP 60 trillion (3.1% of GDP), the MoF increased the total amount including plans for private placements and rising public entities issuances. Indeed, the budget for private placements stands at COP 9 trillion (in addition to the pre-financing private placement of COP23 trillion in 2025; USD 6 billion) and public entities issuances of COP8 trillion (COP 4.5 trillion, previously). Finally, green bond issuance would be doubled up to COP 2 trillion.

Cash is king. In 2026 the MoF will continue to strengthen its cash position. After ending 2025 at COP 27.7 trillion, the MoF is building a foreign currency buffer, that as of February stands close to USD10 billion. The MoF purchased more than USD 3bn in NDFs between November and January and has a total amount of USD 10 billion. Going forward, it is highly likely that the MoF will continue to accumulate dollars, probably reaching USD 12–15 billion.

Our take: We forecast a 7.4% of GDP nominal fiscal deficit in 2026, maintaining pressure on the fiscal accounts, and hence on the sovereign’s rating. While building a foreign currency cash buffer is a positive development, it is likely to exert upward pressure on the currency.