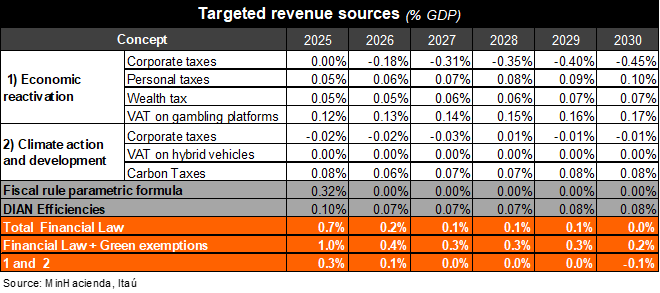

President Petro's government recently sent a bill to Congress that targets a fiscal revenue increase of 0.7% of GDP in 2025, while falling to 0.03% of GDP in 2030. The project focuses on three key components: 1) economic reactivation (0.2% of GDP in 2025; -0.1% of GDP by 2030); 2) environment related measures (0.05% in 2025); 3) fiscal rule modifications that would free up short-term fiscal space along with eyeing the exclusion of green investment spending in the permitted fiscal deficit calculation. A more efficient tax collection process is also considered in the bill’s targeted revenues. Considering the bulk of the targeted revenue in the short-term comes from fiscal rule modifications and efficiency gains, along with optimism over private investment undertaking, the bill will likely be met with scepticism from the market as a much-needed fiscal consolidation path is once more delayed.

1) Economic reactivation.

The bill would eliminate the simplified tax system and introduce a gradual reduction of corporate income tax for non-hydrocarbon and mining companies. The proposal seeks a reduction of the marginal income tax rate from 35% to 33% for corporates with taxable income exceeding USD 1,315 million; to 30% for medium-sized companies with taxable income exceeding USD 70 million; and to 27% for companies below the threshold. This proposal will reduce the weighted average tax rate from 35% in 2024 to 27.5% in 2030 (compared to the current Latin American average of 26.5%). On the other hand, the minimum corporate tax rate would rise from 15% to 20%. According to MoF estimates, this component will boost economic growth by 0.2pp and private investment by 1.1pp in 2025, however the fiscal cost of this adjustments rises over time from 0% of GDP in 2025 to 0.5% of GDP in 2030.

Broaden the base for the personal wealth tax and increase the tax rate on occasional gains. The threshold for the personal wealth tax would be lowered from USD 836 million to USD 460 million, a reduction that will increase the number of taxpayers by over 75,000 and raise revenue by 0.05% of GDP in 2025. The tax rate on occasional gains would rise by 5pp to 20% (0.05% of GDP in additional revenue). A tax deduction for e-invoicing is hoped to improve labor market formality. Meanwhile, VAT on online gambling platforms seen as playing a key role (0.12% of GDP in 2025).

2) Environment related measures

A higher carbon tax rate is seen generating 0.08% of GDP in revenue in 2025 with limited effects on inflation (+0.15bps). The text proposes an energy transition bond for companies investing in renewable energy projects under Law 1715 of 2014. Companies purchasing these bonds will receive a 50% tax deduction on related investments. The MoF estimates an additional 0.1pp of GDP growth in 2025 due to a 1.1pp increase in investment. In addition, hotel services in cities with less than 200,000 inhabitants would be exempt from a 19% VAT rate, a measure which is expected to have a fiscal cost of COP 120.8 trillion in 2025.

Overall, the first two components of the bill raise 0.3% of GDP in additional revenues for 2025, less than half of the total target and fade to negligible amount by the end of the decade. The measures target a positive growth effect of 0.4pp in 2025.

3) Fiscal rule adjustments

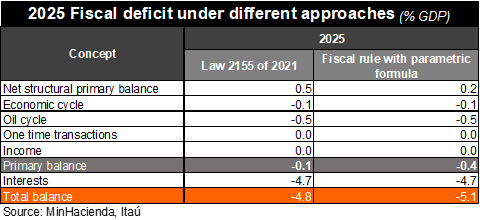

The project aims to modify the transition period of the fiscal rule established by Law 2155 of 2021. The initiative aims to apply the parametric formula of the fiscal rule from 2025 (as opposed to 2026). Under the current transition period, the required structural net primary balance (NSPB) for 2025 is a positive surplus equivalent to 0.5% of GDP, whereas under the parametric formula of the rule the NSPB is set at 0.2% of GDP. As a result, this adjustment frees up 0.3% of GDP for additional spending in 2025. Without such a change, the bill targets a far smaller 0.4% of GDP in 2025.

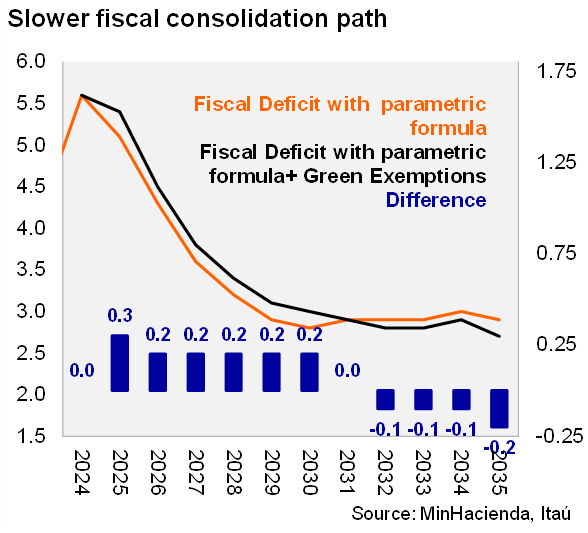

Exempting green investments from the calculation would see the headline fiscal balance rise to 5.4% of GDP in 2025 (from 5.1% currently), and lead to a total deviation of 1.8pp from current deficit targets over the period to 2030.

Our view: The administration's low political capital will see a diluted version of the bill advance. As a result, spending in 2025 would need to come in below current targets in order to comply with the current fiscal rule framework. In January, S&P reduced Colombia's sovereign credit rating outlook to negative. We believe the bar for a downgrade is low in the absence of additional sources of structural revenue. The relaxation of the fiscal rule with the introduction of green exemptions would translate into additional debt, pressuring financing costs.