2025/11/18 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

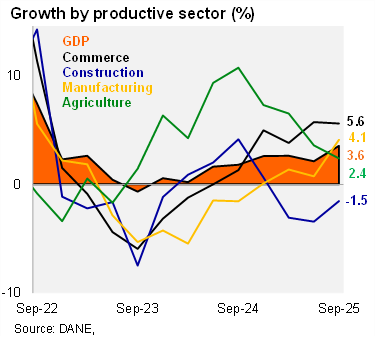

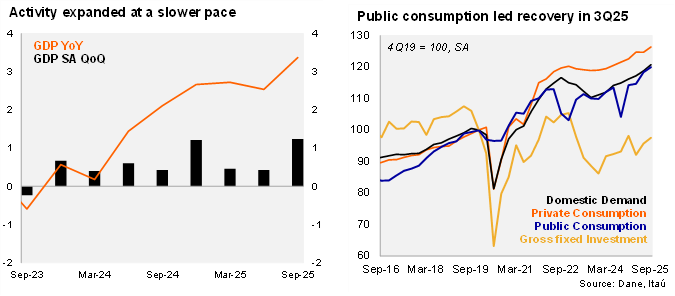

Colombia’s economy grew above expectations in 3Q25. Activity increased 3.6% YoY in 3Q25 (+2.1% in 2Q25), above BanRep’s staff forecast of 3.0% and the Bloomberg market consensus and our +3.2% call. In annual terms, activity was boosted by public administration (+8.0% YoY; +1.3pp), entertainment (+5.7%; +0.2pp) and commerce (+5.6%; +1.2pp). Nevertheless, it was partially countered by construction (-1.5% YoY; -0.1pp) and mining (-5.7% YoY; -0.3pp). Sequentially, the economy rose 1.2% (SA) from 2Q25 to 3Q25 (+0.4% previously), primarily lifted by gross fixed investment, public and private consumption.

While gross fixed investment continues to recover, housing contracted again. Gross fixed investment rose 4.8% YoY (+2.1% in 2Q25), due to an increase in machinery and equipment (+13.9% YoY), but dragged by housing (-8.6% YoY). Total consumption increased by 5.7% YoY (+3.8% YoY in 2Q25), lifted by public consumption rise of 14.2% YoY (+4.5% YoY in 2Q25) and private consumption increase of 4.2% (+3.6% in the previous quarter). Thus, internal demand grew 5% YoY (+4.1% in the 2Q25). Exports increased by 2.2% over one year (-0.7% in the 2Q25), while imports remained with a strong trend, increasing by 10% YoY (+9.8% in the second quarter of the year). On the supply side, the natural resource sector dropped 0.4% YoY (-1.6% in 2Q25), lifted by agriculture, but countered by the mining sector.

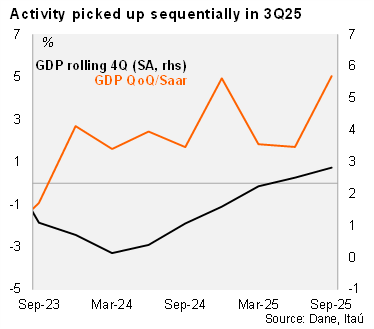

Gross fixed investment, private and public consumption increased at the margin. Activity increased by 5.0% QoQ/saar, up from the 1.7% in the 2Q25. The seasonal and calendar adjusted series show that gross fixed investment increased 7.9% QoQ/saar (+16.4% in the previous quarter), while public consumption rose by 5.6% QoQ/saar (13.5% in the 2Q25) and private consumption rising 5.5% QoQ/saar (-0.1% in the 2Q25). Meanwhile, imports increased by 9.9% QoQ/saar (+12.2% in 2Q25), while exports rose by 6.1% QoQ/saar (2.2% in the previous quarter). The coincident activity indicator (ISE) increased 1.3% from August to September (SA; -2.1% MoM in August). On an annual basis, the ISE posted an expansion of 4.0% YoY in September, boosted (+3.6% YoY and +2.3% YoY respectively).

Our Take: Economic activity continues to surprise positively, supported primarily by strong internal demand. Additionally, the dynamics of government public spending are in line with our upward bias for a fiscal deficit of 7.5% of GDP (compared to the government’s official estimate of 7.1%). The entertainment, commerce and public administration sectors are leading this upward trend. We expect activity to grow 2.7% this year (+1.6% in 2024), while a 2.8% expansion is expected for 2026.