2025/08/05 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

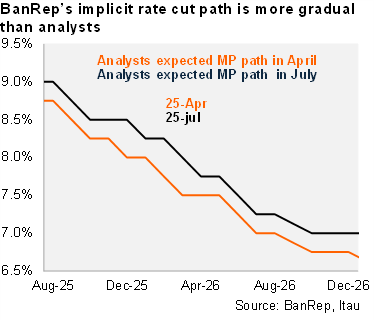

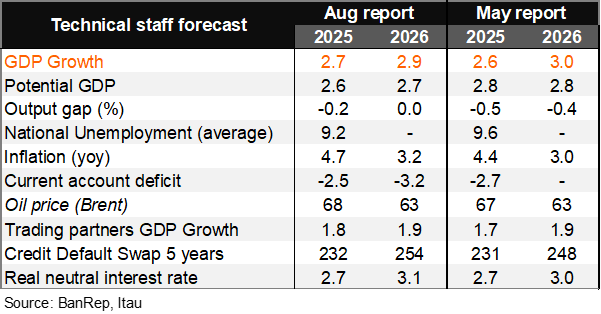

In its quarterly Monetary Policy Report, the Central Bank raised its year-end inflation forecast by 30 basis points to 4.7% (Itaú: 5.1%; 5.2% in 2024), while the 2026 estimate was also increased by 20 basis points to 3.2% (Itaú: 3.6%). Amid upbeat domestic demand, GDP growth for 2025 rose to 2.7% (+10bps), while the 2026 forecast sits at 2.9% (-10bps due to base effects). Regarding monetary policy, the Central Bank staff’s baseline scenario suggests a policy rate trajectory that, on average for 2025 and 2026, remains above market expectations (of 8.6% in Q425 and 7.0% in Q426). The neutral rate estimate for 2025 remained unchanged at 2.7%, while the 2026 projection was revised up by 10 basis points to 3.1%. The rationale behind the neutral rate adjustment lies in a higher risk premium over the policy horizon, reflecting increased fiscal uncertainty.

Higher core inflation would slow the disinflation process. The core inflation forecast for YE25 was increased by 30 basis points to 4.2%, which is above the target range of 2–4%. The YE26 forecast was also increased by 20 basis points to 3.3%, reflecting higher labor costs and stronger domestic demand. Food inflation was revised by 60 basis points to 5.2% driven by higher transport costs, while it remained broadly steady at 2.4% in 2026. Regulated prices remained unchanged at 5.9% in YE25, but were increased by 30 basis points to 3.5% in YE26. The technical staff highlighted the upside risk to regulated prices, given the structural issues in the energy sector, such as postponements of investment decisions and an insufficient domestic gas supply.

Output gap to close by 4Q26. Compared to the previous report, the estimated output gap will narrow this year to -0.4% of GDP (-0.5% in May) and to reach -0.2% of GDP in 2026 ( -0.4% in May) before turning positive in early 2027. Previously, a negative output gap was expected to persist until early 2027. The upward revision in growth is driven by robust consumption and a resilient labor market. Larger-than-expected remittances set to offset a wide trade balance and result in a narrow CAD of 2.5% of GDP in 2025 (2.7% in the previous IPoM).

Heightened global uncertainty and fiscal deterioration behind the upward revision of sovereign risk premium. Following the suspension of the fiscal rule that triggered a persistent increase in domestic public debt in a context of higher global financial costs, the technical staff now estimates an average risk premium of 232 bps in 2025 and 255 bps (previously estimated at 231bps and 248bps). The report assumes that the Fed will implement two 25bp cuts this year (previously three), and another two cuts of the same magnitude in 2026.

Our take: Amid fiscal imbalances, a tight labor market and rising inflationary pressure, there is limited room to resume the interest rate cutting cycle in the short term. Potential price pressures stemming from gas prices and the upcoming adjustment to the minimum wage could further hinder the disinflation process, supporting a cautious stance by the Central Bank.