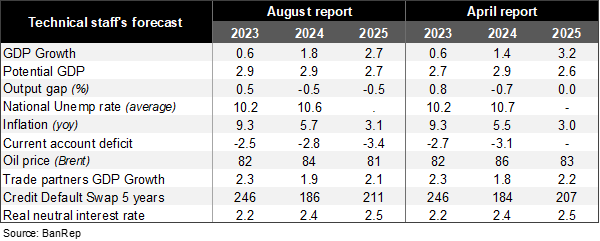

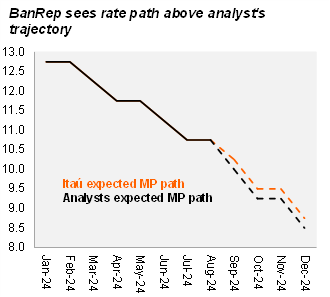

BanRep’s technical staff revised both GDP and CPI up, while outlined an interest rate path that, on average, is above analysts’ expectations (8.5% yearend). Activity this year is now seen growing 1.8% (0.4pp above April’s report, 0.6% in 2022). The more demanding base of comparison supported a revision to 2.7% next year (3.2% previously). The staff’s 2024 yearend inflation forecast was revised up by 0.2pp to 5.7% (Itaú: 5.6%; 9.3% last year), while maintaining the YE25 CPI expectation broadly stable at 3.05% (Itaú: 3.0%). The technical staff’s scenario of converging inflation is coherent with a rate path that results in a yearend rate above the analysts’ survey call of 8.5% (implying that an acceleration from the 50bp cutting pace is not incorporated in the short-term; Itaú YE: 8.75%). The estimated neutral rate was retained at 2.4% for this year (5.4% nominal), and 2.5% for next year.

A negative output gap is still expected. The output gap is seen at -0.5% of GDP in 2024 (-0.7% in the previous report), while revised to the downside the 2025 forecast to -0.5% (0% previously). Potential growth remained stable in 2024 at 2.9%, while it was revised to the upside by 10bps in 2025 to 2.7%.

The main risk to inflation is related to the persistence of the service prices. Although weather-related risks have been dissipating, headline inflation was revised upward due to higher indexation pressures on some services, especially in rent. As a result, headline CPI is expected to fall to 5.7% this year (+0.2pp from the previous report). However, core inflation was revised to the downside to 5.0% (5.1% previously).

Our Take: With short-term activity and inflation revised up, we believe BanRep’s board will remain cautious on rate cuts. We preliminarily expect the Board to cut by another 50bp to 10.25% at the September 30th meeting. However, global developments that may result in a swift loosening of financial conditions may provide room for BanRep’s Board to step up the pace of rate cuts.