2026/02/04 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

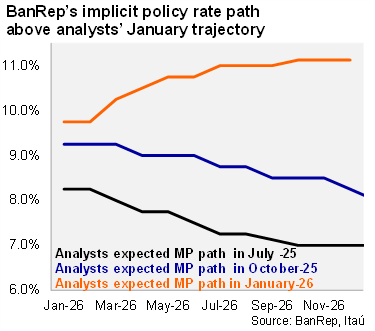

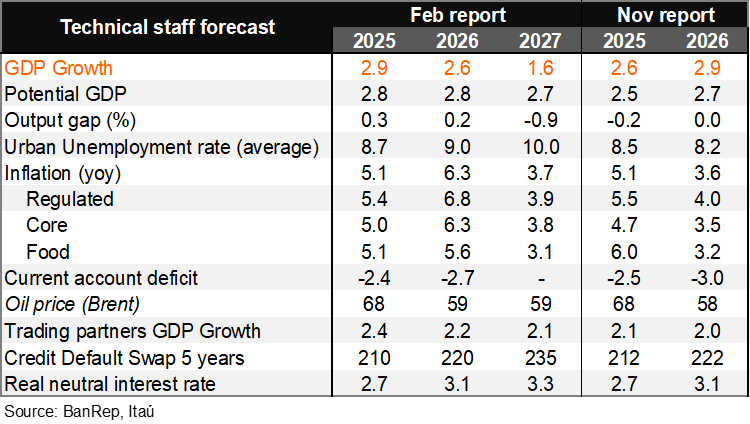

BanRep’s staff implements important changes to their macro forecasts following the unprecedented minimum wage hike. In its quarterly Monetary Policy Report, the 2026 year-end inflation forecast rose by 270 bps to 6.3% (Itaú: 6.7%; analysts: 6.4%; 5.1% in 2025), and 3.7% for YE27 (Itaú: 5.7%, 4.8% analysts). GDP growth for 2025 was revised up by 0.3pp to 2.9%, but the 2026 forecast was adjusted down by 0.3pp to 2.6% and to 1.6% in 2027. The output gap forecast is now expected to swing to negative territory in 2027. Regarding monetary policy, the central bank staff’s baseline scenario implies a policy rate path that is, on average for 2026 and 2027, above analyst expectations for a MPR of 11.1% in 4Q26 and 9.5% at the end of 2027. The staff maintained their real neutral rate estimate at 3.1% for 2026 (3.3% in 2027).

Inflation forecasts were revised up materially, returning to the target range in 2027. The core inflation forecast for YE26 increased by 280 bps to 6.3%, well above the 2–4% target range, while the YE27 forecast was set at 3.8%. Regulated CPI was also revised upward by 280 bps to 6.8% in 2026, and is expected to end at 3.9% in 2027. Food inflation is expected to finish this year at 5.6% (previously 3.2%), returning to 3.1% by YE27. The forecasts now assume a more negative real exchange rate gap, with greater downward pressure on imported prices. The technical staff highlighted that, given the increase in the minimum wage, the projected inflation path foresees rising price pressures throughout 2026, followed by a change in the trend in 2027. Additionally, the report refers to staff research that shows that a 1pp increase in the minimum wage above inflation and productivity has an impact of between 8bps and 16 bps on inflation.

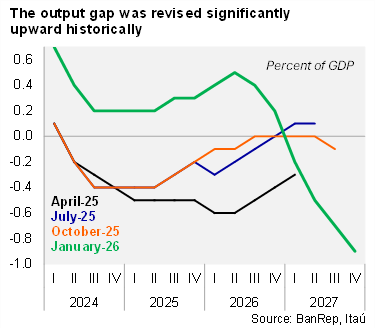

A positive output gap this year, followed by a significant decline in 2027. According to staff estimates, the output gap is now expected to be somewhat positive in 2025 and 2026 (+0.3% of GDP and +0.2%, respectively) before swinging to negative territory in 2027 at –0.9%, which would be the first time it has been negative since 2021. The technical staff emphasized that the strengthening of domestic demand, which is expected to grow close to 4.6% YoY in 2025, driven by both public and private consumption, supports an output gap that would remain positive in 2026. At the same time, the still-elevated primary deficit and growing tourism will continue to support the activity in 2026. However, slower growth in remittances and coffee exports would moderate economic growth this year. For 2027, a more pronounced moderation is expected, explained by the monetary policy adjustment required to bring down inflation.

Our Take: The monetary policy report’s scenario confirms our view of heightened inflationary pressures, in the context of a positive output gap, and above-target inflation expectations. We see BanRep delivering another 100bps hike in March, frontloading the cycle in a bid to anchor inflation expectations at the policy horizon. Our forecast envisages the policy rate ending this year at 12%. The minutes of the last meeting will be released tonight.