2025/11/05 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

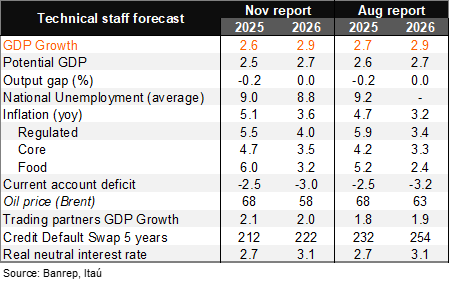

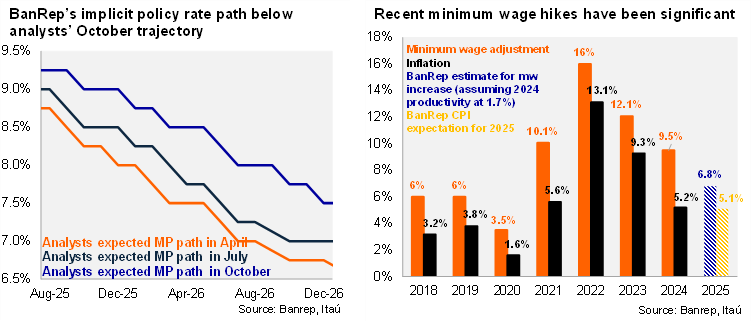

BanRep’s technical staff revised inflation up but kept the neutral rate estimate unchanged. In its quarterly Monetary Policy Report, the year-end inflation forecast rose by 40 bps to 5.1% (Itaú: 5.2%; analysts: 5.2%; 5.2% in 2024), while year-end 2026 CPI is projected at 3.6% (3.2% in the previous report; Itaú: 4.2%; analysts: 4.2%). GDP growth for 2025 was revised slightly down by 0.1 pp to 2.6%, while GDP growth for 2026 remained stable at 2.9%. The output gap forecast remains negative for this year, and closes in 2026. Regarding monetary policy, the central bank staff’s baseline scenario implies a policy rate path that is, on average for 2025 and 2026, below analyst expectations (policy rate at 9.25% at the end of 2025 and 8.5% at the end of 2026). The report clarifies that the monetary policy path outlined by the technical staff does not consider a yearend minimum wage increase above estimated 2025 inflation and productivity growth. In our view, a significant real minimum wage hike would increase inflation persistence. The staff kept the neutral rate for this year at 2.7% and 3.1% for 2026.

A slow disinflationary process is expected. The core inflation forecast for YE25 increased by 50 bps to 4.7%, well above the target range of 2–4%, while the YE26 forecast rose by 20 bps to 3.5%. Regulated CPI was revised downward by 40 bps to 5.5% in 2025, while it increased by 60 bps to 4.0% in 2026. The technical staff highlighted that although a decline in core inflation is still expected, this decrease would be slower than previously anticipated amid strong indexation pressures and a slower disinflationary process in rents and restaurant prices. Food inflation was revised up by 80 bps in 2025 and 2026 to 6.0% and 3.2%, respectively.

A narrower current account deficit is expected in 2026. The technical staff expects the CAD to widen to 2.5% of GDP in 2025 (1.7% of GDP in 2024; stable in the previous IPoM), but revised the 2026 estimate from 3.2% to 3.0% of GDP, as a widening trade deficit is offset by favorable transfer dynamics.

The sovereign risk premium was revised downward. The technical staff lowered the 2025 CDS expectation from 232 bps to 212 bps and now expects the 2026 CDS at 222 bps (previously 254 bps). The staff noted that Colombia’s risk premium has declined, following the regional trend. However, persistent increases in public debt are expected to still weigh on local risk premium.

Our Take: The BanRep technical staff highlighted the minimum wage announcement as one of the main forward-looking risks to inflation. In the context of a solid labor market and favorable private consumption dynamics, rebounding inflation, above target CPI expectations, and persistent fiscal imbalances, we believe the scope for monetary policy easing ahead is limited. Our forecast envisages the policy rate unchanged at 9.25% until 2H26.