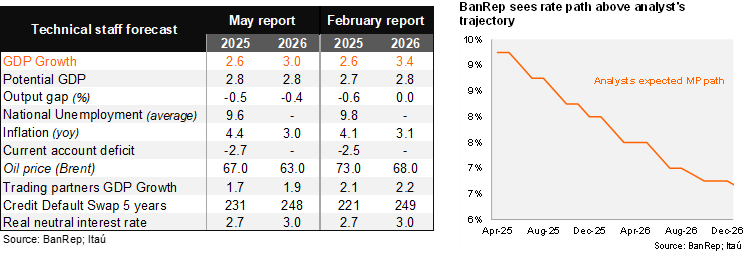

BanRep’s technical staff revised inflation up, and now expects a weaker activity rebound. In its quarterly Monetary Policy Report, the yearend inflation forecast rose by 30bps to 4.4% (Itaú: 4.5%; 5.2% in 2024). GDP growth for 2025 remained at 2.6%, with increased global uncertainty wiping out a prior upwards bias (2.8% in March). The recovery during 2026 is now seen at 3% (down 0.4pp). Regarding monetary policy, the central bank staff’s baseline scenario implies a policy rate path that is, on average for 2025 and 2026, above the analysts’ expectations (policy rate at 8.3% in 4Q25 and 6.8% in 4Q26). The staff kept the neutral real rate for this year at 2.7% and 3.0% for 2026.

Higher regulated prices and food lift the inflation outlook. However, the core inflation forecast for YE25 remained stable at 3.9%, within the target range of 2-4%, while the YE26 stayed at 3.1% (stable from the previous scenario). Regulated CPI was raised by 97bps to 5.9% in 2025, while broadly steady at 3.1% in 2026 (3.2% previously expected). The technical staff highlighted the upside risk to regulated prices given the possible need to import gas, that would spillover to higher electricity prices. Food inflation was revised up by 1.3pp to 4.6% in 2025 due to upside pressures in imported agriculture inputs.

Amid fiscal strain, the sovereign risk premium was revised up. The technical staff acknowledged fiscal and external uncertainty has led to an increase in the CDS, which adds volatility to the exchange rate, affecting tradable prices. The staff notes that under both international and local economic conditions, the upside risks to inflation outweigh the downside risks to economic growth (a view that favors a cautious MP strategy).

Negative output gap to persist in 2026 and early 2027. According to staff estimates, the output gap will narrow this year to -0.5% (-0.6% previously expected) and is expected to narrow to -0.4% in 2026 and to -0.3% of GDP in 1Q27. Previously the output gap was seen closing by YE26. The downside revision in GDP growth is driven by greater global uncertainty, denting global trade.

A wider, but still manageable current account deficit. The technical staff expects the CAD to widen to 2.7% of GDP in 2025 (2.5% in the previous IPoM), amid the recovery of domestic demand. Moreover, weaker global growth may moderate remittance inflows.

Our take: With the disinflationary process expected to continue, we expect the Board to continue reducing the restrictivenes of MP with cuts of 25bps per meeting. Risks to inflation persist, stemming from COP depreciation and energy price adjustments, while domestic fiscal uncertainty remains elevated, conditions that support a cautious cutting strategy.