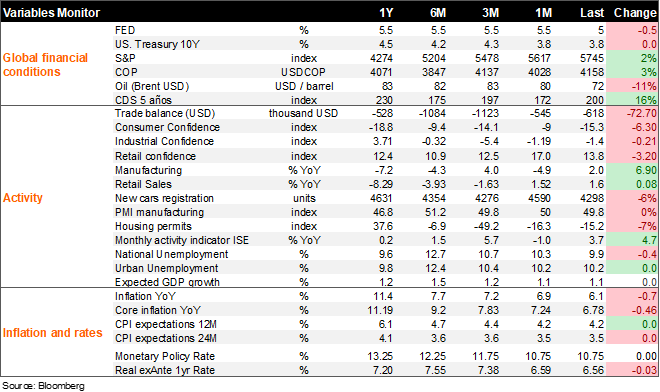

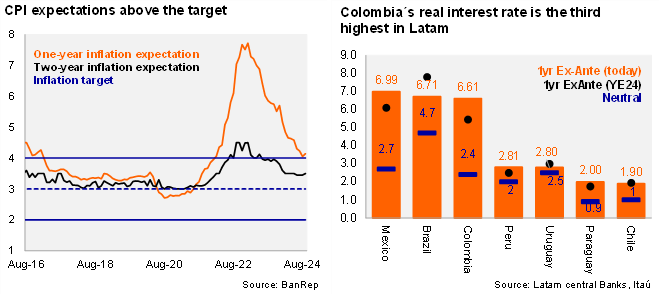

We expect BanRep to cut by another 50bps to 10.25% at the September 30th meeting. In July, for the fourth consecutive meeting with a divided decision, BanRep cut the policy rate by another 50bps to 10.75%, with two members voting for an even greater cut (-75bp). The minutes showed that the majority (5 members) believed a larger cut might risk the inflation convergence path and jeopardize the continuity of the cycle. Factors supporting the cautious stance included: 1) the persistence of elevated and sticky services inflation; 2) high risk premium amid a challenging fiscal scenario; 3) uncertainty over COP dynamics amid oil price volatility and external uncertainty; and 4) a real interest rates that are lower than Brazil and Mexico, economies with lower inflation.

In the run-up to the September monetary policy meeting, all of the above-mentioned factors remain present and, in some cases, have intensified with the possible prospect of slowing the disinflation process. We acknowledge that the Fed's dovish pivot opens some additional space for emerging economies to advance with the cutting cycle. Nevertheless, domestic risks that stem from the effects of the transportation strike on food prices and uncertainty over the minimum wage adjustment may draw the focus of the Board for the time being. Recent surveys show a divided market with just over 50% of analysts surveyed by BanRep favoring a larger 75bp cut, while asset prices are more inclined towards continuing with the 50bp pace.

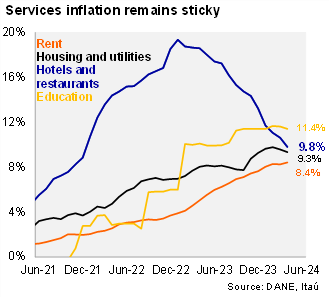

On the inflation front, July and August prints (0.20% MoM and 0% MoM) surprised to the downside, and brought inflation 107 bps below the June CPI to 6.12% YoY, mainly driven by lower food prices. While the disinflation process has recently been faster than expected, headline inflation remains well above the long-term target and continues to have the widest gap (312bp) among Latin American peers (Brazil and Mexico are 190pb and 70pb away from the 3% target, respectively). Disinflation of core services has been slower, declining only 44pb since the July meeting to 7.25% YoY. Specifically, the rental CPI remains well above target (7.93%YoY), as do other services such as hotels and restaurants (8.8%YoY) and education (10.6%YoY). This inertia proves the high indexation mechanisms both to past inflation of 9.3% in 2023 and to the minimum wage adjustment of 12% in 2024 (16% and 10% in previous years).

We expect the transportation strike to have a limited inflation effect. According to our estimates, headline inflation will rise 0.28% MoM and 5.85% YoY in September, below BanRep technical staff estimate of 6.30% at the end of 3Q24.Nevertheless , we expect core inflation to continue to disappoint with a 5.91% YoY print, above the staff’s forecast for 3Q24 (5.53%).

The one- and two-year inflation expectations remain above target. Since July, the yearend inflation expectation dropped 8bps to 5.60%, while the one-year outlook dipped 9bps to 4.14%. The two-year outlook increased 5bps to 3.50%. Colombia’s one-year ez-ante real rate is the third highest in the region, but given better behaved inflation dynamics in peer economies and a conservative MP stance, accelerating the rate cutting pace domestically would likely pile pressure on the COP.

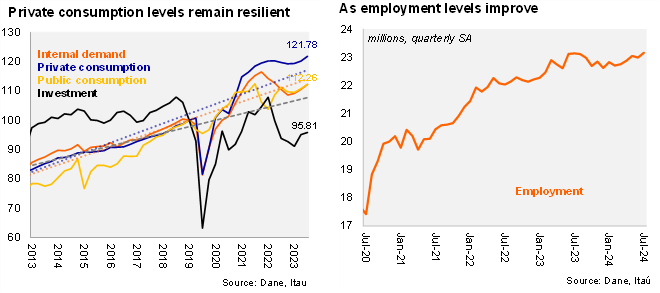

Activity and labor market remain resilient. On the activity front, the 2Q24 GDP was in line with the technical staff's estimates (1.8% sa YoY ) in line with a narrower negative output gap for the year compared to estimates earlier in the year. The coincident activity indicator (ISE) surprised to the upside in July. Reduced economic slack is likely to provide less room for disinflation ahead. The unemployment rate fell below BanRep's NAIRU estimate (11.2%) in July.

On the external front, the Federal Reserve frontloaded the start of the interest rate cut cycle with a 50pb cut and signaled further adjustments in 4Q24. The BanRep's July monetary policy report assumed a single cut of 25pb in 4Q24 and a total of 100bp in 2025. As a result, global financial conditions are set to be less restrictive, giving the board more room to continue the cycle of interest rate cuts, but not necessarily enough confidence to accelerate the pace just yet. For BanRep, the terminal level of the global cycle likely matters most, rather than the speed of the cycle.

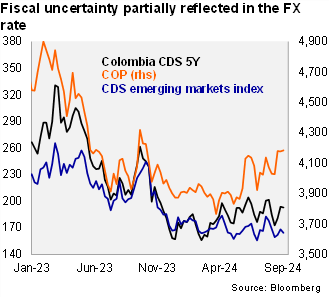

Despite the more benign financial conditions, the COP is under pressure. The -11.4% fall in the Brent price to USD 71 has pushed the local currency down by -2.4% over the intermeeting period. Despite more upbeat private consumption, the CAD has narrowed significantly, boosted by higher transfers, reducing the COP volatility to global shocks.

Heightened domestic political uncertainty and the decline in oil prices, likely offset the benefits of a more benign external environment. Amid the recent impasse on the national budget, the risk premium (5YR CDS) has risen to 200 bps (a level not seen since late 2023). The possibility of a fiscal rule breach in 2025 and the government's attempts to relax the fiscal rule framework point to a still expansionary fiscal stance going forward, which could hinder the disinflation process as well as inflation expectations.

Our take: We expect another 50 bp cut in a 5-2 split decision. Yet growing pressure to increase the pace of easing may result in a swifter cycle during 4Q24. Transitory supply shocks will have a limited impact of CPI, but in combination with the possible materialization of several other risk factors (fiscal scenario; oil; COP; minimum wage), the disinflationary process may not advance as expected. As a result, we expect BanRep will wait for more clarity on the upside risks to inflation to be considered in the October Monetary Policy Report. However, we cannot rule out the possibility of a more divided vote (4-3) given FED developments. The minutes of the meeting will be released on October 3rd.