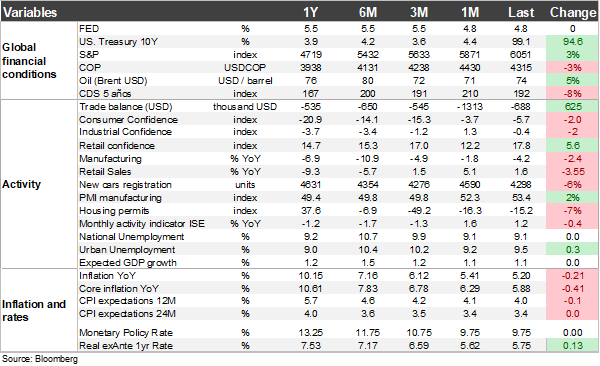

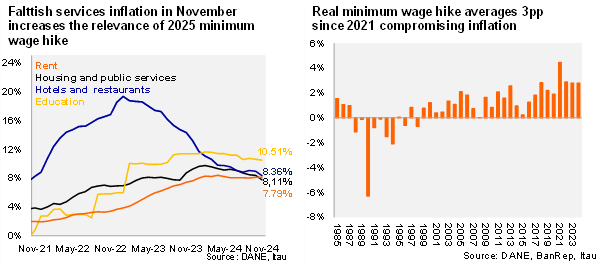

We expect BanRep to maintain the 50bp pace in December. Sticky services inflation, above-target core inflation expectations, market pricing of fewer Federal Reserve rate cuts in 2025, heightened domestic fiscal uncertainty and a volatile COP, strengthen our case to retain the pace of the easing cycle. We expect the Board to cut 50bp to 9.25% at its December 20 meeting. Since September, the Board has been split 4-3 in favor of a 50bp cut, with the minority in favor of 75bp. The minutes showed that the majority (4 members) voted for a 50bp cut to 9.75% highlighted the unfavorable impact of the currency depreciation on inflation, recalling the persistence of services inflation at high levels despite the contractionary MP stance and the risks that could arise from a large minimum wage hike in 2025. As a result, a bolder cut of 75 pb at this stage could jeopardize the convergence path of inflation and the continuity of the cycle.

Domestic factors are not helping. Core services inflation remains elevated (7.28% in November), consumption dynamics gained momentum in 4Q24, the size of the 2025 minimum wage adjustment remains unclear, while inflation expectations continue to reflect the largest gap to the target in Latin America (ex-Brazil). Additionally, the fiscal outlook has worsened in the short- and medium-term with the approval of the reform of the Generalized System of Preferences (SGP).

Consumer price pressures surprised to the downside in Q3 and Q4, with inflation falling 61bp from the September CPI to 5.20% YoY in November, the lowest level in 24 months. Nonetheless, the ex-food and ex-regulated measure has adjusted by only -9pb since September and remains above headline inflation at 5.95% YoY and substantially above BanRep’s technical staff forecast for December (5.12%).

The balance of risks to inflation remains skewed to the upside. In addition to the 2025 minimum wage adjustment, for which anything above 7% could derail the CPI convergence to 3%, there is now an accumulated exchange rate depreciation of 10.6% on a YTD basis, raising pass-through to domestic price risks. Indeed, in the latest CPI print, core goods inflation rose by 0.29% , compared to a monthly average of -0.1% in the previous six prints.

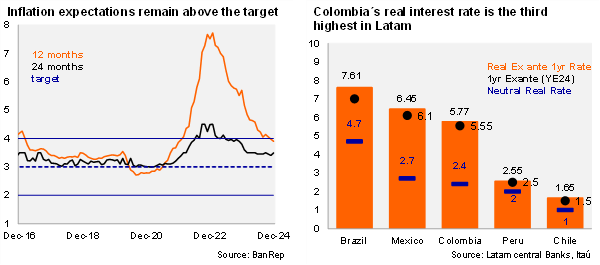

With cumulative downside inflation surprises of 43bp in 2024, inflation expectations have improved. The one-year outlook has dropped by 180bp YTD (8bp since the October central bank survey) and is now within the target range at 3.90% for the first time since January 2022. Similarly, core inflation expectations for the next 12 and 24 months have improved to 3.82% and 3.30%, respectively. While there is a significant improvement, inflation expectations remain far from the 3% target confirmed by the board for 2025.

Tighter global financial conditions. Since the last meeting, not only has the 10-year US Treasury note risen to 4.3%, but we also revised our Fed forecast to fewer cuts through 2025.

The recent rejection of the financing bill points to a challenging fiscal scenario. While the authorities have repeatedly stressed the importance of adhering to the fiscal rule, the task of controlling expenditure pressures will become more difficult during a pre-election year. Moreover, the constitutional amendment of the Generalized System of Preferences reform adds uncertainty to the medium-term fiscal accounts, which, according to the Central Bank, in a scenario without the competence law, the reform could shift the budget deficit by 1.9 percentage points to 4.7% and net debt by almost 10 percentage points to 64.6% in 2038. Indeed, Governor Villar and other members of the Board pointed to the recent approval of the SGP reform, noting that fiscal uncertainty could have undesirable effects on inflation.

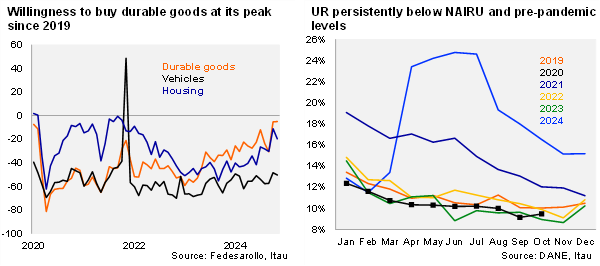

Activity in 4Q24 is recovering, confirming we are over the hump on the macroeconomic adjustment. Consumer confidence is at the least pessimistic level since 2021. The unemployment rate completed more than 12 months below the NAIRU at 9.5% in October.

Market consensus favors a 50bps cut. BanRep’s surveys show only 5.1% of analysts favor a larger 75bp cut in December (21% in October´survey), while asset prices have priced in 50bps since mid year. Rate cuts are expected to continue as Colombia's one-year ex-ante real rate currently stands at 5.77%, the third highest in the region and well above the neutral estimate of 2.4%),

Our take: Developments since the last meeting favor a cautious approach towards a 50bp cut this month, albeit in another divided decision. Looking ahead on the domestic front, fiscal discussions and the size of the minimum wage adjustment in 2025 should be key. The minutes of the meeting will be published on December 26.