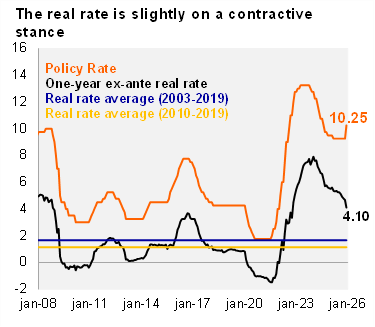

BanRep’s board increased the policy rate by 100bps to 10.25%, a stronger-than-expected adjustment to start the hiking cycle. The decision was above the Bloomberg median of 9.75%, and our 10% call. The split decision saw four members voting for a 100bps hike, one member voting for a stable rate, and two members supporting a 50bp cut (including the Finance Minister). Following the decision, the one-year ex-ante real rate reached 4.1% (based on the monthly analysts’ survey), above BanRep’s real neutral rate estimate of 3.1% for 2026, an estimate that could be revised next week in the quarterly monetary policy report. Governor Villar highlighted that inflation in December closed at 5.1%, slightly below the level observed in 2024 (5.2%), while core inflation increased from November to December. Analysts’ inflation expectations rose sharply following the minimum wage adjustment. Future decisions will be data dependent.

CPI revised up following the significant minimum wage increase. At the previous Board meeting, year‑end inflation for 2026 was expected to reach 4.1% (from 3.6% expected at 3Q25 IPOM). However, the technical staff revised the projection to 6.3% for YE26. The main reason for the sharp monetary policy adjustment is to ensure that inflation expectations remain aligned with the Central Bank’s target. Governor Villar noted that the 23% minimum wage increase, though high, was common before the Central Bank gained independence. The 1991 Constitution, which granted independence to the Central Bank, also gave it the role of reassuring workers that inflation would not rise to levels that would prevent real wage increases.

Activity was revised up for 2025, and down for 2026. Governor Villar highlighted that recent macroeconomic indicators suggest that economic activity continues to show solid momentum, leading the technical staff to expect that the economy grew 2.9% in 2025 (up from the previously expected 2.6%). However, the 2026 growth was revised down to 2.6% (2.9% in the last monetary policy report). For its part, the current account deficit is widening and is expected to reach 2.4% of GDP in 2025, compared with 1.6% observed in 2024. This is explained by a significant increase in imports driven by domestic demand, along with a decline in mining‑energy exports.

Uncertainty in the external environment remains elevated. External uncertainty continues to be high amid a potential escalation of trade conflicts, U.S. migration policies, geopolitical tensions, and Colombia’s sovereign risk perception.

The Ministry of Finance announced a decline in fuel prices in an attempt to contain inflation. The local fuel price in Colombia is almost COP 16,000 (USD 4.32 per gallon), which is higher than the international price of around COP 14,000 (USD 3.78 per gallon). Consequently, the COP 500 cut per gallon (-3.1%), announced by the Ministry of Finance, would subtract seven basis points from headline inflation. Additionally, the Finance Minister noted that the financial plan is expected to be released at the beginning of the week.

Our take: Following the de-anchoring of inflation expectations resulting from the significant increase in the minimum wage, we believe the majority of the Board will continue its frontloaded hiking cycle at the next meeting, scheduled for March 31. The magnitude of the adjustment will depend on the degree of indexation pressures on inflation and the behavior of inflation expectations. We see a yearend rate of 12%. The Monetary Policy Report is scheduled for release on Tuesday February 3, followed by the meeting minutes Wednesday February 4.