2025/10/31 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

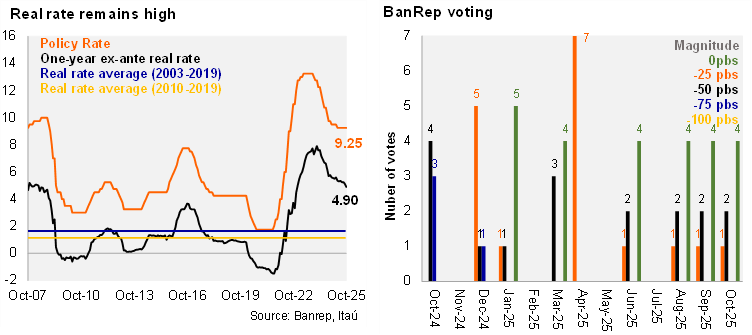

As widely expected, BanRep Board held the policy rate at 9.25%, marking the fourth consecutive pause. The split decision saw four members voting for hold, one member favoring a 25bp cut, and two members supporting a larger 50bp cut, the same breakdown as in the last three meetings. The one-year ex-ante real reaches 4.90% (using the monthly analysts survey), above BanRep’s real neutral estimate of 2.7% in 2025 (3.1% in 2026). Governor Villar emphasized that among the key arguments for the decision were inflation dynamics with September’s CPI increasing again for the third consecutive month, reaching 5.2%, while the core metric remained stable at 4.8%. On the other hand, inflation expectations at the two-year policy horizon continue to stand above the 3% target. On the economic front, domestic demand maintains strong momentum, reflected in a widening trade deficit. Finally, external financial conditions are less tight due to the Fed’s rate cuts. Villar emphasized that upcoming decisions will depend on the evolution of inflation and expectations, the dynamics of economic activity, and the balance of internal and external risks.

Inflation dynamics and expectations call for caution. Villar noted that the technical staff expects inflation to remain relatively stable through year-end before resuming a downward trend in early 2026. September’s unfavorable inflation and rising expectations pushed convergence to the target range to 1H27, prompting the Board to hold rates. Governor Villar highlighted the challenges posed by sharp increases in the minimum wage on inflation targets.

Monetary policy will remain contractionary. Governor Villar affirmed that monetary policy remains restrictive, supporting the disinflation process, where the neutral interest rate is lower than the current real interest rate. Villar remarked that the policy rate will remain stable for a longer period than previously anticipated, with the possibility of being reduced later on, though other decisions cannot be ruled out as inflation risks materialize going forward.

Domestic demand continues to drive activity. Villar highlighted that the technical team estimates economic growth for this year at 2.6% (previously expected at 2.7%), while maintaining the expectation for 2026 at 2.9%. Villar remarked the output gap has remained slightly negative, but is approaching potential growth faster than expected.

Our Take: The rebound in inflation, de-anchoring of inflation expectations, strength of domestic demand, and persistent fiscal imbalances limit the room for monetary policy easing. We anticipate that BanRep will keep the policy rate unchanged at 9.25%, at least until the 2H26. The Monetary Policy Report is scheduled for release on November 5, followed by the meeting minutes on November 6.