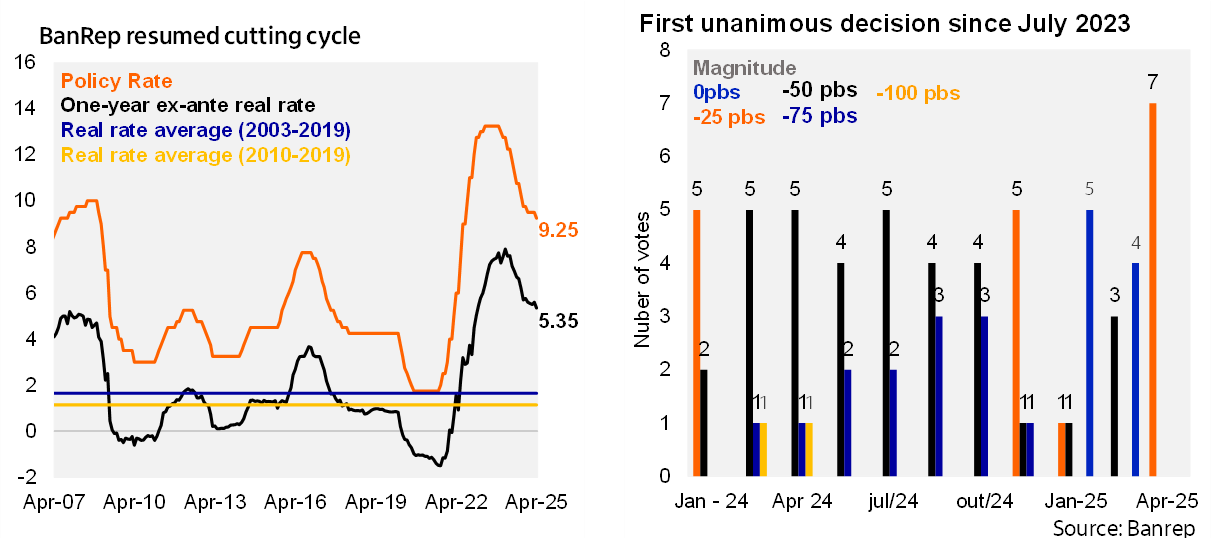

BanRep’s Board unanimously cut the MPR by 25bps to 9.25%. There was broad market consensus to keep rates on hold. The unanimous cut is a significant swing from the 4-3 vote to hold rates at the March meeting and is also the first unanimous decision since July 2023. Following the decision, the one-year ex-ante real rate fell to 5.35% (using the monthly analyst survey; -25bps from the previous meeting), above BanRep’s real neutral rate estimate of 2.7% in 2025 (3.0% in 2026). Governor Villar highlighted the resumption of the disinflation process as key to the decision. The technical staff revised this year’s GDP growth estimate down by 20bps to 2.6% this year and by 40bps to 3.0% for 2026, given the weaker global outlook.

The disinflationary process is expected to advance further. BanRep’s yearend inflation forecast remains close to 4%. According to the statement, monetary policy decisions are aimed at ensuring that inflation converges to the target by the end of 2026. Previous stay-on-hold rate decisions were in part taken to accumulate more inflation data and reduce uncertainty on the inflation trend.

Regarding recent developments on access to the IMF’s FCL, Villar remarked there had been no discussion on an international reserve accumulation program, as stocks remain at “adequate levels” and global volatility restricts space to act in the FX market.

MoF will focus on fiscal stability. The MoF signaled the budget cut will be structured in June’s MTFF, and a new financing bill would be presented to Congress. The Minister of Finance also stated that the decree that seeks to advance the collection of withholding tax from 2026 to 2025 will be issued in the next few days (The Tax-Office expects additional collection of COP7 trillion, 0.4% of the GDP).

Our take: We expect the disinflationary process to continue but at a gradual pace (YE CPI rate of 4.5%), permitting a cautious cutting cycle. We expect a YE25 MPR of 8.25%, but with a downside bias given today’s surprise. The IPoM on May 5 will have the technical staffs updated macroeconomic projections, structural parameters, and its rate guidance. The minutes of today’s meeting will be released on May 6. The next meeting is on June 27.