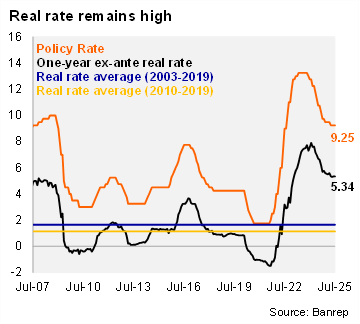

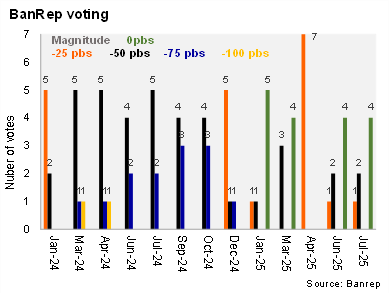

As in June, a majority of the BanRep Board favored holding the policy rate at 9.25% for a second consecutive time. A 25bp cut was both the Bloomberg market consensus and our call. The Board remained divided along June lines with four members voting for a pause, one member opting for a 25bp cut and two members favoring a 50bp cut. Following the decision, the one-year ex-ante real rate remained broadly stable at 5.34% (using the monthly analyst survey), above BanRep’s real neutral rate estimate of 2.7% in 2025 (3.0% in 2026). Governor Villar highlighted that although headline inflation fell from 5.1% to 4.8% between May and June, it was driven by energy prices, and inflation expectations remained above the target. Additionally, core inflation was steady at 4.8%, interrupting its downward trend. Base effects ahead will limit the pace of the disinflationary process during 2H25. Villar emphasized the importance of the Central Bank’s autonomy, amid growing political pushback.

Inflation expectations are concerning. The Board members who voted to keep the policy rate at 9.25% expressed concern over the persistence of high inflation expectations. A renewed downward trajectory of core CPI could open room for additional easing in the future. We see several inflation risks abound, including another large real minimum wage increase by yearend.

The technical staff expects solid activity growth in 2Q25. The technical staff estimates annual growth of 2.7% in 2Q (compared to 2.6% in the previous IPoM), driven by domestic demand, which is expected to grow 4.1% year-over-year (4.7% in 1Q). Robust consumption (amid an overheated labor market in our view) brings an additional layer of caution to the Board.

Global financial conditions merit a wait-and-see approach. High uncertainty on international trade tariffs amid a restrictive monetary policy in the United States has strained global financial conditions.

Our take: With three policy meetings remain, risks tilt to fewer cuts to our yearend rate call of 8.75%. Inflation remains high, amid a tight labor market and fiscal risks persist. The IPoM, to be published on August 4, will include the technical staff’s macroeconomic projections and a likely upward revision to the inflation expectations and the neutral rate. The minutes will be released on August 5. The next meeting will take place on September 30.