2025/09/30 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

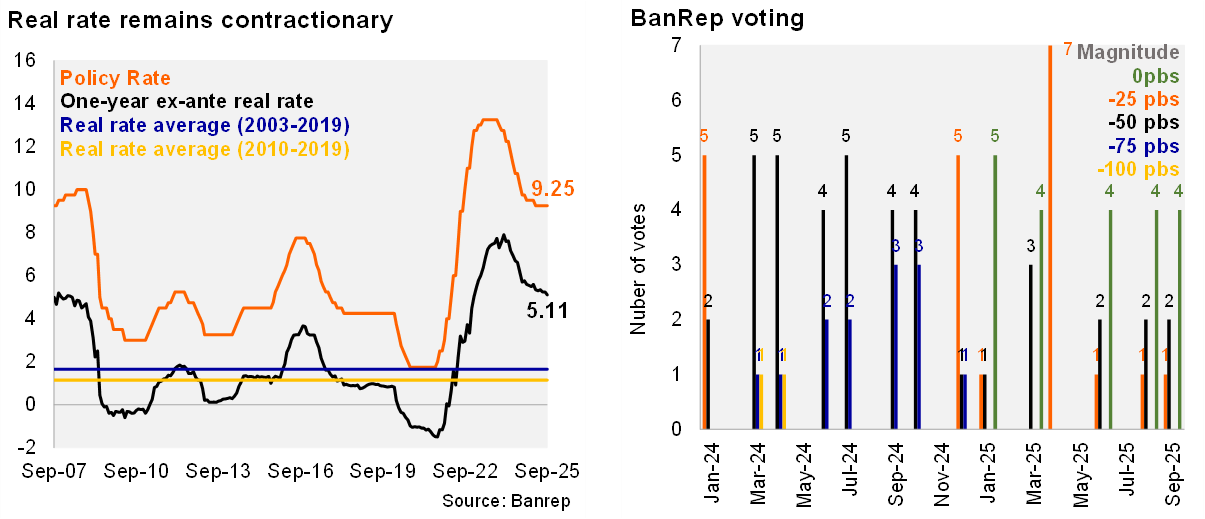

A majority of the BanRep Board held the policy rate at 9.25%, marking the third consecutive pause. The decision was in line with the Bloomberg market consensus and our call. The split decision saw four members voting for hold, one member favoring a 25bp cut, and two members supporting a larger 50bp cut (Finance Minister included). The one-year ex-ante real reaches 5.11% (using the monthly analyst survey), above BanRep’s real neutral rate estimate of 2.7% in 2025 (3.1% in 2026). Governor Villar emphasized that most members are maintaining a cautious stance, acknowledging the risks associated with inflation converging to the target. Nevertheless, he emphasized that the Board's discussion has centered between holding and lowering the policy rate, yet the downward disinflation trend is less clear than before. Villar stated that an interest rate hike has not yet been considered a plausible option given the contractionary levels of monetary policy.

Inflation dynamics remain a concern. August inflation stood at 5.1%, while core CPI stood at 4.8%, exceeding the technical staff's forecasts. Therefore, the technical staff's updated forecast scenario will show a slower convergence toward the 3% target. Villar noted the staff expects a yearend inflation of just below the 5% projected by analysts, before only reaching the 3% target in the first half of 2027. Villar highlighted that the balance of risks on inflation remain skewed to the upside.

Favorable activity dynamics. The 2.5% growth in Q2 was in line with the technical team's estimate, reflecting strong domestic demand. Villar indicated that the technical staff estimates GDP growth of 2.7% for this year, similar to the estimate in the last monetary policy report.

More favorable external financial conditions, but risks remain. Financial conditions are less restrictive, but uncertainty remains regarding the effect of U.S. trade policy and global geopolitical tensions on Colombian financial and macroeconomic variables.

The Flexible Credit Line (FCL) agreement was terminated. Governor Villar announced that Colombian authorities chose to cancel the FCL agreement with the IMF (USD8.1 billion). The current FCL agreement began in April 2024, but access was suspended by the IMF in April this year, pending the conclusion of the Article IV assessment. Governor Villar believes the international reserves are at an adequate level (USD 65.5 billion, 13.8% of GDP), thanks to the reserve accumulation program carried out in 2024 (USD 1.5 billion) and portfolio returns (USD 4.5 billion during 2024 and 2025). Villar emphasized that the cancellation of the FCL has no impact on the repayment schedule agreed upon in 2020, with the final installment due in December 2025.

Our take: Sticky inflation, increasing inflation expectations, strong consumption dynamics, and a large fiscal imbalance limit space for monetary policy action during the final two meetings of the year. We expect Banrep to hold the monetary policy rate at the current 9.25% through yearend. The minutes will be released on October 3. The next meeting will take place on October 31. September’s inflation print will be released on October 7 at 8 PM (BRT time).