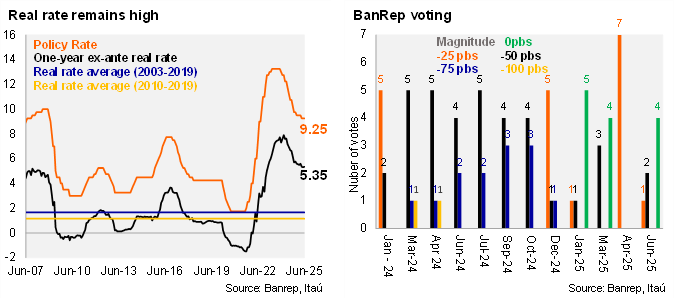

The BanRep Board held the policy rate at 9.25%, marking the third non-consecutive pause since the beginning of the easing cycle. The decision was in line with the Bloomberg market consensus and our call. The split decision saw four members voting to hold, one member favoring a 25bp cut, and two members supporting a larger 50bp cut (Finance Minister included). Following the decision, the one-year ex-ante real rate remained stable at 5.35% (using the monthly analyst survey), above BanRep’s real neutral rate estimate of 2.7% in 2025 (3.0% in 2026). The press release states that inflation fell marginally between April and May, while inflation expectations remain above the target. The updated fiscal path poses a challenge to the sustainability of public finances and reduces the room for monetary policy easing. Economic growth dynamics are improving, leading the technical staff to increase the 2025 forecast by 10bps to 2.7%. Global financial conditions remain tight amid heightened global geopolitical tensions. Uncertainty about the U.S. tariff hike policy has eased but remains high. Upcoming monetary policy decisions will dependent on the evolution of macroeconomic data. The MoF expressed its preference to lower rates to boost economic growth and aid a swifter fiscal consolidation.

Fiscal deterioration limits room to maneuver. Governor Villar stated that high fiscal deficits limit the political space to lower interest rates. Regarding the suspension of the fiscal rule, Villar emphasized the importance of analyzing the sustainability of public finances. Villar added that fiscal uncertainty is only one factor considered in the decision-making process with the Board also noting the deterioration of inflation expectations and external uncertainty.

The disinflationary process has been slower than expected. Governor Villar affirmed that a slow disinflationary process, amid the stickiness of services, makes it difficult to reach the 3% inflation target this year. Regarding the impact of the approved labor reform, the technical staff will conduct its analysis and communicate its finding in due course. Additionally, a reserve accumulation program has not been considered, as the current level of USD 64 billion is adequate according to IMF standards. Villar highlighted that BanRep does not expect the financing of Treasury operations by the Ministry of Finance to impact liquidity.

Our take: With slower disinflation and a deteriorated fiscal scenario, risks tilt towards several pauses in the cutting path ahead. Additional price uncertainty stems from next year’s minimum wage negotiation (yearend) and higher labor costs resulting from the labor reform. The recent downgrades from Moody's and S&P also support caution. The minutes from this meeting will be published on Thursday, July 3, while the next monetary policy meeting will take place on Thursday July 31 with updated forecast by the Technical staff. We see a yearend rate of 8.5%, with risks tilted towards fewer cuts.