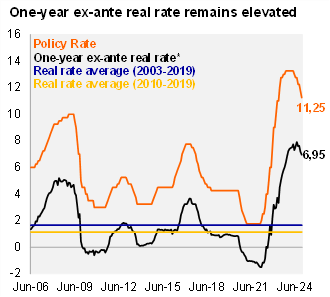

In a divided decision, BanRep continued with the 50bp rate cut pace, while a minority still favored a swifter cycle. For the third consecutive meeting, two board members voted for a larger cut, but this time both opted for a 75 bp cut (in the previous meeting the dissident votes were split between 75 and 100 bps). Four members favored the 50bp cut, while board member Jaime Jaramillo was absent. Following the decision, the one-year ex-ante real rate fell to 6.95% (using the monthly analyst survey; -17bps from the previous meeting in April), well above BanRep's real neutral rate estimate of 2.4%. Governor Villar highlighted that future monetary policy decisions will continue to be data dependent.

Growth expectations are favorable. Minister Bonilla and Governor Villar highlighted that activity dynamics have improved. The technical staff maintains a growth expectation of 1.4% for this year (0.6% in 2023).

Tighter global financial conditions have led to a depreciation of the exchange rate. Governor Villar emphasized that international financial conditions have remained tight amid inflation and uncertainty on the Federal Funds Rate path. The country's risk premium has increased, leading to the depreciation of the currency. However, the current dynamics have not met the threshold to trigger the need for FX intervention. No international reserve accumulation options were executed in June. So far this year, the program has accumulated international reserves by USD 825 million, of which USD 400 million were accumulated in 2Q24.

Fiscal concerns eased following latest update. The Governor acknowledged the government’s effort to reduce spending and pursue public debt sustainability. The muted market reaction to Moody's outlook was flagged as a show of confidence in the government's fiscal commitment.

The pace of policy rate cuts will continue to depend on the speed of the disinflation process. The current real interest rate remains contractionary. Falling inflation permits the lowering of nominal rates to prevent a re-tightening of MP.

Our take: We expect the disinflation process to advance gradually, justifying a cautious rate cut path. The La Niña phenomenon will be a risk for inflation, along with the expectation that the removal of subsidies should raise diesel prices in the second half of the year. Moreover, weaker COP dynamics may put pressure on the prices of tradable goods, while the central bank will remain attentive to the behavior of global financial conditions. We expect the Board to continue with the 50bp rate cut pace in the next meetings. This meeting’s minutes will be released on July 4, and the next monetary policy meeting is scheduled for July 31.