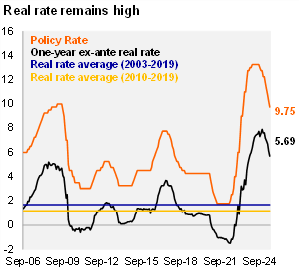

The interest rate returned to single digits. In a divided decision, BanRep maintained the pace of cuts at 50bp from 10.25% to 9.75%. As in the previous meeting, three members voted for a larger cut (75bp) and four members favored a 50bp cut. Following the decision, the one-year ex-ante real rate fell to 5.7% (using the monthly analyst survey; -42bps from the previous meeting in September), well above BanRep’s real neutral rate estimate of 2.4%. Governor Villar signaled that year-end inflation projection were revised downward to 5.3% (5.7% previously), with survey data remaining stable at around 3.8% at the end of 2025. Moreover, the technical staff revised upward its growth projection for 2024 to 1.9% (1.8% previously) and 2025 to 2.9% (2.7% in the last IPoM). The exchange rate has shown a depreciation due to the strength of the dollar, falling oil prices and domestic fiscal noise. Therefore, if it becomes persistent, it could have an effect on inflation. Governor Villar remarked that the reduction of the interest rate has been significant, but the rate remains restrictive.

The technical staff revised to the upside the GDP growth for 2024 to 1.9% and 2.9% for 2025. Nevertheless, MoF Bonilla pointed out that it will not be easy to return to potential growth, given the gap between observed income and projected spending. A recovery of income through the reactivation of the economy is essential, hence the importance of continuing to lower the interest rate.

Tighter global financial conditions prevent a larger cut. As inflation expectations have increase on the verge of US elections and the 10 year US treasury accumulated a surge of 50pb in the last month, global monetary policy seems to enter in a recalibration phase with plausible higher terminal rates. In this context, a small open economy has less freedom to accelerate without risking capital outflows.

Domestic fiscal noise has contributed to the depreciation of the COP. Governor Villar signaled that fiscal uncertainty in Colombia is due to short- and medium-term factors, among which are the low tax collection, the shortfalls in the national budget of the 2025 and the reform to the General System of Participations (SGP) that is advancing in Congress, which could compromise the sustainability of public finances. Therefore, Governor Villar remarked the importance of clearing the doubts about the reform to calm the markets and maintain the country's macroeconomic stability. Moreover, Villar signaled that a deterioration in the fiscal accounts could put upward pressure on the neutral rate. Indeed, the surge of fiscal risks pushed the 5yr CDS to its highest level in 2024.

Our take: The recent rise in local fiscal noise and tighter global financial conditions justifies maintaining a cautious stance, given the uncertainty regarding next year's minimum wage increase, sticky services inflation and the heightened fiscal pressure amid SGP discussions. On the other hand, an acceleration in the short term cannot be ruled if inflation data remains favorable and external conditions revert their tightening after the US presidential election. On Tuesday, the central bank will publish its monetary policy report for 3Q24, while the minutes of October’s monetary policy meeting will be released on Wednesday. The next monetary policy decision would take place on Friday December 20th.