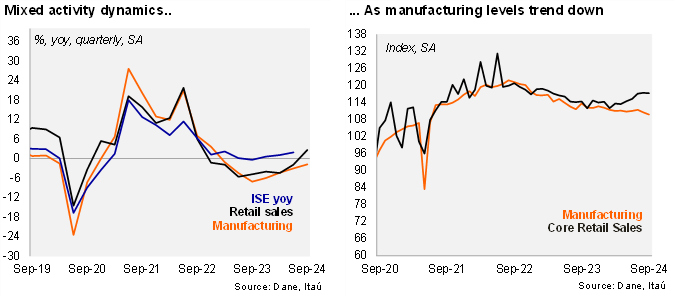

Weak September dynamics likely linked to transportation strike. Retail sales increased by 1.5% yoy in September (+5.1% in August), well below the Bloomberg market consensus of +3.9% and our +5.5% call. Core retail sales (excluding fuels and vehicles) fell 0.1% from August (MoM/SA), leading to a 1.3% yoy expansion (+5.1% yoy in August). Meanwhile, manufacturing fell 0.7% mom/sa, leading to a contraction of 4.2% yoy (-1.8% previously), well below the Bloomberg market consensus of -1.4% and our +0.7% call.

Manufacturing contracted again in 2Q24. Manufacturing contracted by 1.4% in 3Q24, after falling 1.6% in 2Q24. At the margin, manufacturing dropped 1.5% qoq/saar (-2.0% in 2Q24). Manufacturing levels are now 6.4% above pre-pandemic levels (down from a near 18% peak during 3Q22).

Core retail sales increased sequentially in 3Q. Retail sales increased 2.8% yoy during the quarter (-0.6% in 2Q24), while core retail sales rose by 1.8% (-1.3% in 2Q24). At the margin, core retail sales accelerated to 10.5% qoq/saar (+3.9% in 2Q24), possibly signaling some boost from a lower inflation and interest rate environment.

Our take: Weak activity data reflects the impact of the transporters' strike in the first week of September. The 3Q24 GDP release will be released on November 18, where despite solid growth in July and August, September will end up restricting the activity performance in 3Q24. We estimate growth of 2.5% yoy (2.1% in 2Q). Alongside the publication of the national accounts, the monthly coincident activity indicator (ISE) for September will also be released. We expect an increase of 2.1% yoy, boosted by services, but partially countered by commerce and manufacturing due to the transport workers' strike during the first week of September.