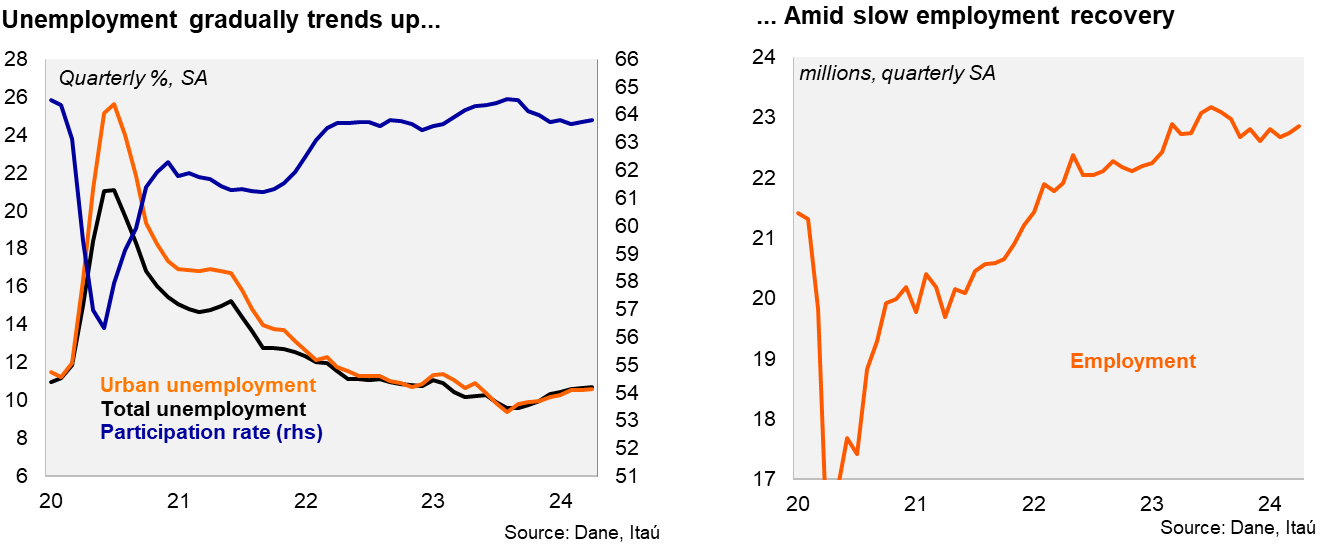

The unemployment rate in April surprised to the downside, but continues to gradually trend up at the margin. The national unemployment rate reached 10.6%, down by 0.1pp over one year, while the urban unemployment rate fell to 10.3% in April, down by 0.7pp, partly due to lower participation. The latter was well below the Bloomberg market consensus of 11% and our 11.3% call. Employment increased by 0.5% YoY in April (-0.7% in March), the same increase was observed in the labor force (+0.5%; +0.8% in March). The participation rate fell by 0.6pp from April last year to 64%. At the margin, total employment increased by 0.5% MoM/SA from March (+0.3% increase in the previous month), but the unemployment rate (SA) ticked up to the highest rate since February last year.

Private salaried posts drive employment dynamics. In the quarter ending in April, employment increased 0.3% yoy (1.0% in 1Q24), supported by private salaries posts (3.3% yoy; +2.6% in 1Q24). On the other hand, public sector jobs dropped by 1.5% yoy (-3.4% in 1Q24), and self-employment fell 2.4% (-1.3% in 1Q24). Financial and insurance activities, real state activities, and transportation were key job drivers over twelve months.

Our Take: We expect the unemployment rate to average 10.6% this year, somewhat above the 10.2% average of 2023 (11.2% in 2022). Even though the labor market has surprised favorably, weak economic activity, still contractionary monetary policy and elevated inflation will likely lead to some loosening ahead.

Andrés Pérez M.

Vittorio Peretti

Carolina Monzón

Juan Robayo