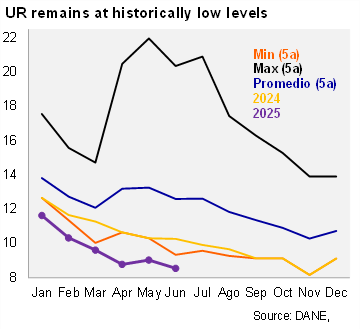

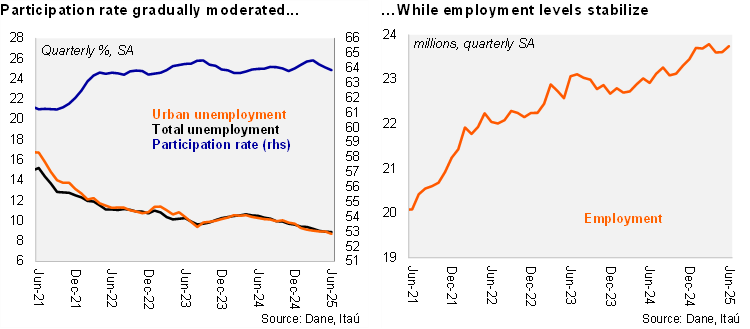

The unemployment rate remained low, but employment fell sequentially in the 2Q. According to DANE’s June labor market survey, the national unemployment rate reached 8.6%, down 1.7pp over one year, while the urban unemployment rate was 8.3% in June (dropping 1.8pp over one year) the lowest level on record for June. The urban unemployment rate was well below the Bloomberg market consensus of 9.1% and our 9.0% call. Total employment increased 3.6% YoY in June (+2.6% in May), while the labor force rose by 1.7% (+1.2% previously). The participation rate increased by 0.2pp from June 2024 to 63.9%. The national unemployment rate (SA) fell to 8.9% (9.0% in the previous month) and the urban unemployment rate (SA) fell to 8.4% (8.9% in May; BanRep’s NAIRU: 10.2%). In 2Q25, the seasonally adjusted unemployment rate fell to 8.9%, lower by 0.3pp from 1Q25. Sequentially, employment rose by 0.6% MoM/SA from May to June, but fell 0.3% between 1Q25 and 2Q25.

Self-employment and private salaried posts were the main job creators in the 2Q. During the 2Q25, employment growth increased to 3.1% YoY (4.3% in 1Q25). The annual increase was pulled up by self-employment (+5.7% in 2Q25; +7.0% in 1Q25), while private salaried posts increased by +2.7% YoY (+3.1% in 1Q25). On the other hand, public sector jobs fell by 0.8% (-4.2% in 1Q25). Manufacturing, hotels and restaurants and public administration were key job drivers in the 2Q25.

Our take: Labor market dynamics continue to surprise favorably. We see downside risks to our 9.6% average unemployment rate call for 2025. An overheated labor market amid high inflation and fiscal uncertainty limits BanRep's policy space for significant easing ahead.