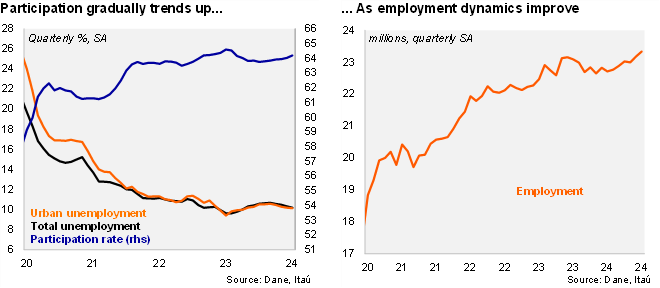

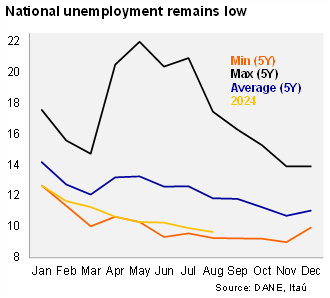

Employment increased sequentially. The national unemployment rate reached 9.7%, up by 0.4pp over one year, while the urban unemployment rate increased to 10% in August, up by 0.4pp from August 2023, in line with the Bloomberg market consensus and our call. Employment increased 1.1% YoY in August (+0.1% in July), while the labor force rose by 1.5% YoY (+0.5% in previously). The participation rate increased a mild 0.1pp from August 2023 to 64.5%. Sequentially, employment increased by 0.7% MoM/SA from July (+0.8% in the previous month), while the unemployment rate (SA) remained stable from the previous month at 10%.

Private salaried posts remain a key employment driver. In the quarter ending August, employment increased 0.2% YoY (+0.7% in 2Q24), supported by private salaried post (1.6% YoY; +2.8% in 2Q24). On the other hand, public sector jobs fell by 4.8% YoY (-2.3% in 2Q24), and self-employment fell by 1.2% YoY (-2.5% in 2Q24). Services, manufacturing, hotels and restaurants were key job drivers on an annual basis. Nevertheless, favorable dynamics were partially countered by real state sector, financial and insurance activities and public administration.

Our take: We expect the unemployment rate to average 10.6% this year, above from the 10.2% average of 2023 (11.2% in 2022). Despite the improved activity dynamics, key sectors such as construction and manufacturing are still not showing clear signs of recovery, so we continue to expect a further cooling of the labor market in the second half of the year.