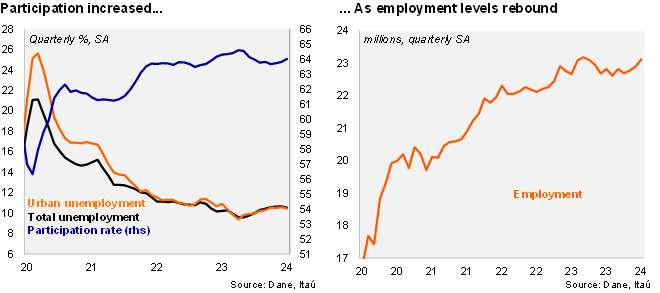

The unemployment rate remained low in May, as employment dynamics surprisingly improved at the margin. The national unemployment rate fell to 10.3%, down by 0.2pp over one year, same as the urban unemployment rate that came in at 10.3% (a 0.9pp drop over one year), below the Bloomberg market consensus and our call of 10.5%. Employment increased by 2.0% YoY in May (+0.5% in April), while the labor force rose by 1.9% (+0.5% previously). The participation rate increased by 0.2pp from May 2023, up to 64.1%. Sequentially, employment increased by 1.0% MoM/SA from April (+0.6% previously), while the unemployment rate (SA) fell by 0.1pp from the previous month at 10.3%.

Private salaried posts remain a key employment driver. In the quarter ending in May, employment increased 0.6% yoy (0.3% in 1Q24), supported by private salaried posts (+3.5% yoy; +3.3% in 1Q24). On the other hand, public sector jobs fell by 2.4% yoy (-1.5% in 1Q24), and self-employment fell 3.0% (-2.4% in 1Q24). Construction, real estate activities, and entertainment were key job drivers on an annual basis.

Our Take: We expect the unemployment rate to average 10.6% this year, above from the 10.2% average of 2023 (11.2% in 2022). Despite better-than-expected activity dynamics, still high borrowing costs and elevated inflation should lead to a gradual loosening of the labor market.