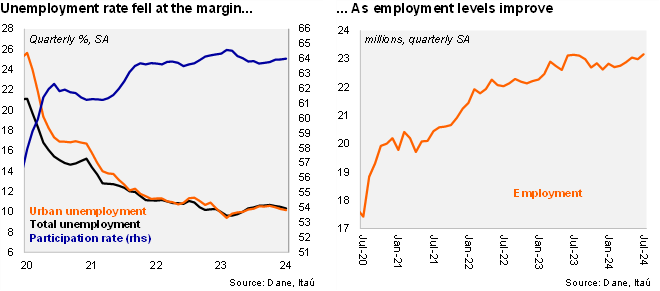

Employment increased sequentially in July. The national unemployment rate came in at 9.9% in July, up by 0.3pp over one year, while the urban unemployment rate came in at 10.2% (a 0.4pp increase over one year), slightly below the Bloomberg market consensus and our call of 10.3%. Employment increased by 0.1% YoY in July (-0.6% in June), while the labor force rose by 0.5%, stable from the previous month. The participation rate fell by 0.6pp from July 2023 to 64.2%. Sequentially, employment increased by 0.7% MoM/SA from June (-0.2% previously), while the employment rate (SA) fell by 0.6pp from the previous month to 10% (11.4% recent peak in January 2023).

Private salaried posts remain a key employment driver. In the quarter ending in July, employment increased 0.5% yoy (+0.7% in 2Q24; 1.0% in 1Q24), supported by private salaried posts (+2.3% yoy; +2.8% in 2Q24). On the other hand, public sector jobs fell by 3.4% (-2.3% in 2Q24), and self-employment dropped by 2.4% (-2.5% in 2Q24). Real estate activities, communications and hotels and restaurants were key job drivers on an annual basis, but partially countered by drop in transportation, financial and insurance activities, commerce and construction.

Our Take: We expect the unemployment rate to average 10.6% this year, somewhat above the 10.2% average of 2023 (11.2% in 2022). Although the economy reflected better dynamics in the second quarter of the year, key sectors such as manufacturing, commerce and construction still remain weak, which supports our view of a gradual cooling labor market in the second half of the year. However, amid a still resilient labor market and inflation above target, we expect Banrep to maintain a cautious approach (50bp cut) at the next MP meeting on September 30.