2025/10/08 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

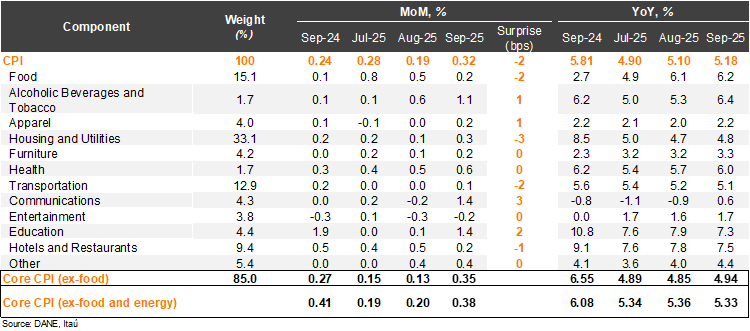

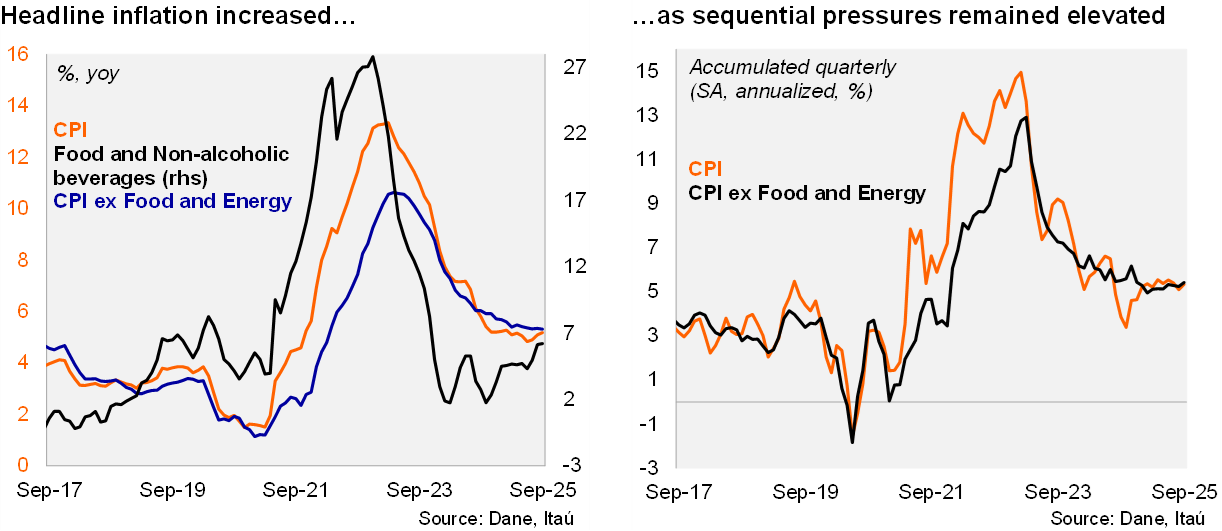

Annual inflation rebounded for the third consecutive month, surprising consensus to the upside. Consumer prices rose by 0.32% MoM in September, above the Bloomberg market consensus of 0.26%, but closer to our 0.34% call. The main positive contributors in the month were housing and utilities (+0.31%; +10bps), beverages and tobacco (+1.1%; +7bps) and education (+1.4%, +6bps). Meanwhile, food prices rose a mild 0.18%, contributing 3bps. Consumer prices excluding food rose by 0.35% MoM (+0.27% one year earlier), while inflation excluding food and energy rose by 0.38% MoM (+0.41% one year ago). On an annual basis, headline inflation increased by 8bps from August to 5.18% in September, while core inflation fell mildly by 3bps to 5.33%. Cumulative inflation in the year through September rose to 4.5% (unchanged from 2024), already above the ceiling of the tolerance range around the central bank’s 3% target.

Non-durable goods rebounded, while services inflation remained at a high level. Non-durable good inflation (mainly food) came in at 4.5% YoY, increasing by 40bps from the previous month. Meanwhile, energy inflation rose 101bps to 1.6% YoY, amid a lower base comparison from last year. Durable goods remained broadly stable from the previous month at 0.16% YoY. Services inflation dropped by 14bps to 6.3 (9.51% peak in September 2023). At the margin, we estimate inflation accumulated in the quarter reached 5.3% (SA, annualized, +5.5% in 2Q25). Core inflation remains elevated at 5.4%, from 5.3% in 2Q25 (SA, annualized).

Our take: Our preliminary estimate for October’s monthly inflation, scheduled for release on November 10, ranges between 0.1% and 0.2%, leading the annual CPI print to increase to between +5.4% and +5.5%. In the last months of the year, base effects and pressure over food and gas prices will lead CPI to remain above 5%. As a result, the bar remains high for any cut in the MP rate this year. We forecast the policy rate unchanged at 9.25% for the rest of the year, and a gradual decline to 8.25% by the end of 2026.