2025/08/11 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

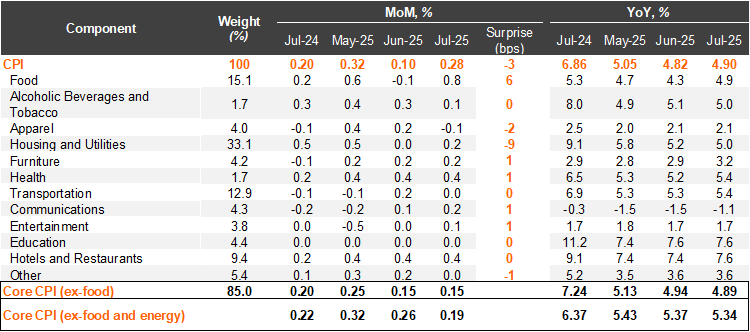

Inflation rebounded in July. Consumer prices rose by 0.28% MoM in July, above the Bloomberg market consensus of 0.2%, but closer to our 0.31% call. The main positive contributors in the month were food prices (+0.82%; +15bps), housing and utilities (+0.19%; +6bps), and hotels and restaurants (+0.35%; +4bps). Housing explained most of the surprise relative to our forecast as we were expecting an even higher print for regulated prices, while food prices surprised us to the upside. Consumer prices excluding food rose by 0.15% MoM (+0.20% one year earlier), while inflation excluding food and energy rose by 0.19% (+0.22% one year ago). On an annual basis, headline inflation increased by 8bps from June to 4.90% in July, while core inflation fell slightly by 3bps to 5.34%. Cumulative inflation in the year through July rose to 4.02% (4.32% in 2024), already above the ceiling of the tolerance range in the central bank’s 3% target.

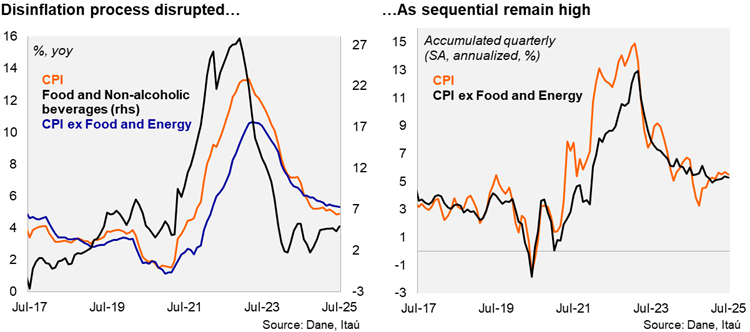

Services inflation remains sticky at an elevated level. Non-durable goods inflation (mainly food) came in at 3.54% YoY, increasing 20bps from the previous month. Meanwhile, energy inflation dropped -19bps to 1.13% YoY, amid a negative contribution from gas and electricity prices. Durable goods rose by 12bps from the previous month to -0.01%, despite the COP’s favorable performance. Services inflation remained broadly stable at 6.5% (9.51% peak in September 2023). At the margin, we estimate that inflation accumulated in the quarter reached 5.5% (SA, annualized; +5.7% in 2Q25). Core inflation remains elevated at 5.3%, from 5.4% in 2Q25 (SA, annualized).

Our take: Our preliminary estimate for August's monthly inflation, scheduled for release on September 8, ranges between 0.2% and 0.3%. Due to the low base comparison from August 2024, the annual CPI is expected to show another upward shift. In the second half of the year, base effects and pressures on gas prices are likely to challenge the disinflationary process. Therefore, the bar is high for cuts to the monetary policy rate in the short term. We expect a yearend rate of 8.75% with risks tilted to upside.