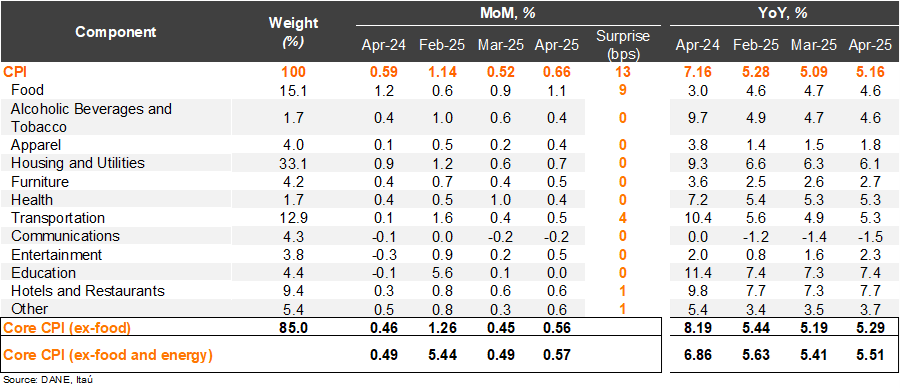

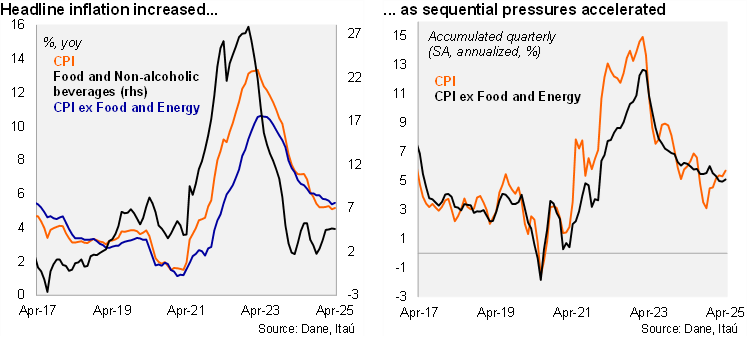

Consumer prices rose by 0.66% MoM in April, well above the Bloomberg market consensus of 0.50% and our 0.53% call. The main positive contributors in the month were housing and utilities (+0.74%; +23bps), food prices (+1.1%; +21bps) and hotels and restaurants (+0.63%; +7bps). Food prices explained most of the surprise relative to our forecast. Consumer prices excluding food increased 0.56% mom (+0.46% one year earlier), while inflation excluding food and energy rose by 0.57% (+0.49% one year ago). On an annual basis, headline inflation increased by 7bps from March to 5.16% in April, while core inflation rose by 10bps to 5.51% (10.60% peak in April last year; 8.8% at the end of 2023). Cumulative inflation in the year rose to 3.3%, already above the central bank’s target.

A widespread acceleration in inflation, as services remained elevated. Non-durable goods inflation (mainly food) came in at 4.0% yoy, increasing 10bps from the previous month. Meanwhile, energy inflation rose to 3.6% yoy, above in 21bps from March. Durable goods inflation remained in negative territory at -1.5%, but increased 41bps from the previous month. Services inflation remained stable at a still high 6.8% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter rose to 5.7% (SA, annualized; 4.6% in 4Q24). Core inflation decelerated to 5.1%, from 5.6% in 4Q24 (SA, annualized).

Our take:April’s inflation print was an unwelcome surprise, raising concerns regarding the pace of the disinflation process. Our preliminary estimate for May’s CPI, to be released on June 9, is between 0.25% and 0.35%, resulting in annual inflation falling close to 5.0%. Our YE25 CPI call is at 4.5% yoy, but with an upside bias, given stronger than expected food price dynamics. Amid elevated domestic risk premium and volatile currency dynamics, BanRep may opt to maintain a cautious stance in the easing cycle, after the 25bps cut made in April’s meeting. The next policy rate setting meeting, set for June 27, at which time the Board will have May’s CPI, more clarity regarding the Medium-Term Fiscal Framework, and the Fed’s mid-June decision.