2026/02/09 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

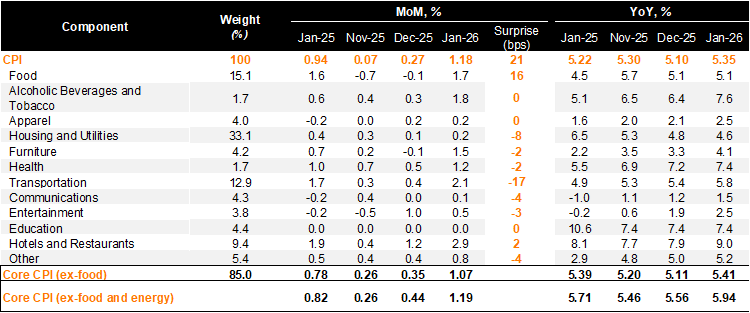

Annual core and headline inflation rebounded again. Consumer prices rose by 1.18% MoM in January (0.94% one year ago), broadly in line with the Bloomberg median of 1.21%, but well below our 1.39% call. The main positive contributors in the month were hotels and restaurants (+2.94%; +33bps), food prices (+1.66%; +31bps), and transport (+2.14%; +29bps). Transport and housing prices explained most of the surprise relative to our forecast. Consumer prices excluding food rose by 1.07% (+0.78% one year earlier), while inflation excluding food and energy increased by 1.19% MoM (+0.82% one year ago). On an annual basis, headline inflation increased by 25bps from December to 5.35%, the highest since October 2025, while core inflation increased by 38bps to 5.94%, the highest since November 2024.

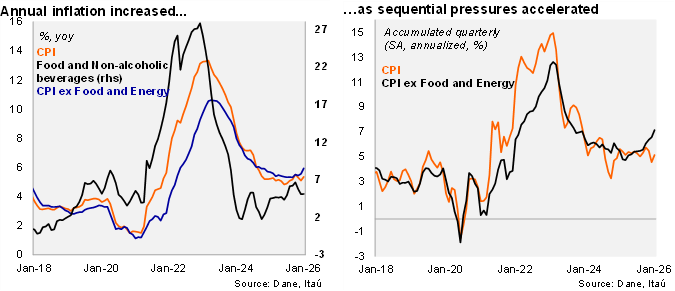

After the minimum wage announcement, service prices rebounded. Non-durable goods inflation (mainly food) came in at 4.09% YoY, remaining broadly stable from the previous month. Meanwhile, energy inflation fell 38bps to 0.84% YoY. Despite the exchange rate appreciation, durable goods inflation ticked up 6bps to 0.53% YoY. More concerning was the services inflation increase of 43bps to 6.85% (9.51% peak in September 2023), responding to the higher cost pressures. At the margin, we estimate inflation accumulated in the quarter reached 5.1% (SA, annualized, +4.6% 4Q25). Core inflation rose to 7.1%, up from 6.6% in 4Q25 (SA, annualized).

Our take: Our preliminary estimate for February’s monthly inflation, scheduled for release on March 6, ranges between 1.2% and 1.4%, resulting in the annual CPI print rising to between 5.4% - 5.6%. After the minimum wage increase and amid strong indexation pressures, we expect a YE26 CPI of 6.7% (analyst survey & BanRep’s staff: 6.3%). Given that upside inflation risks will persist in the near-term, we see BanRep delivering an additional 100bps hike in March, front-loading the cycle in a bid to re-anchor inflation expectations. Our forecast envisages the policy rate ending this year at 12%.