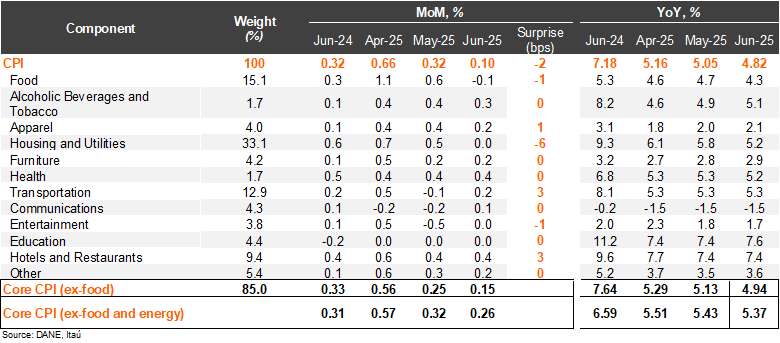

A downside inflation surprise in June. Consumer prices rose by 0.10% MoM in June, below the Bloomberg market consensus of 0.17%, while closer to our 0.12% call. The main positive contributors in the month were hotels and restaurants (+0.42%; +5bps) and transport prices (+0.20%; +3bps). Housing and utilities and food prices explained most of the surprise relative to our forecast, given the electricity (-7bps) and potato prices (-6bps) declines. Consumer prices excluding food increased 0.15% MoM (+0.33% one year earlier), while inflation excluding food and energy rose by 0.26% (+0.31% one year ago). On an annual basis, headline inflation fell by 23bps from May to 4.82% in June, falling back below 5%, a level not seen since October 2021, while core inflation dropped by 6bps to 5.37%. Cumulative inflation in the year rose to 3.69% (4.06% in 2024), already above the central bank’s target.

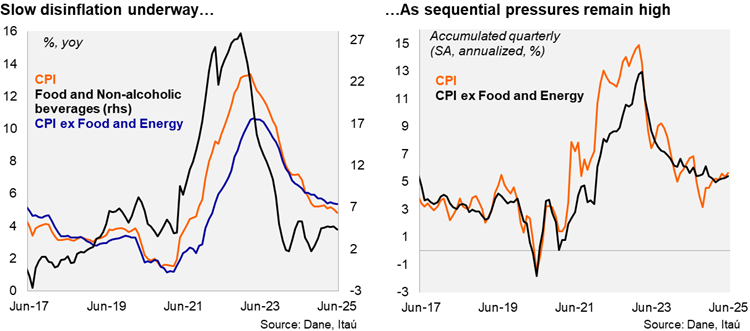

Services inflation remained elevated, reflecting pressures from above-inflation wage adjustments. Non-durable goods inflation (mainly food) came in at 3.34% YoY, falling 55bps from the previous month. Meanwhile, energy inflation fell to 1.3% YoY, down 143 bps from May. Durable goods inflation remained in negative territory at -0.13%, increasing 37 bps from the previous month despite the COP appreciation. Services inflation fell by 8 bps to a still high 6.51% YoY (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter reached 5.6% (SA, annualized; +5.2% in 1Q25). Core inflation remains elevated at 5.4%, from 5.2% in 1Q25 (SA, annualized).

Our take: Our preliminary estimate for July inflation, scheduled for release on August 8, ranges between 0.2% and 0.3%, leading to an annual inflation to remaining broadly stable at 4.8%. Our year-end projection stands at 5.1% YoY. Despite the lower print in June, the disinflationary process is expected to face resistance in the second half of the year due to a low base of comparison. In the short term, favorable inflation dynamics are likely to create an opportunity to continue the easing cycle. We anticipate a year-end policy rate of 8.50%, with an upward bias.