2025/11/11 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

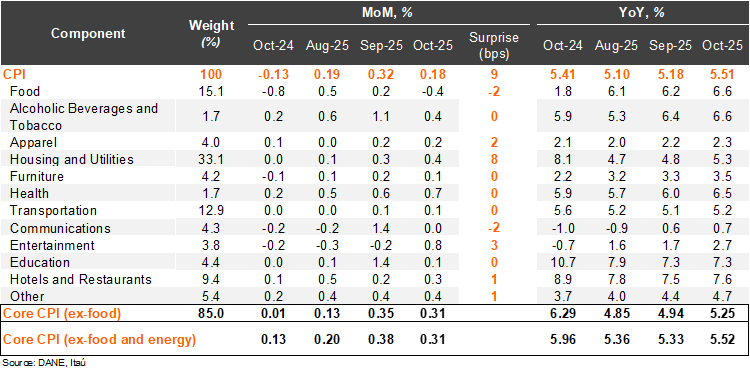

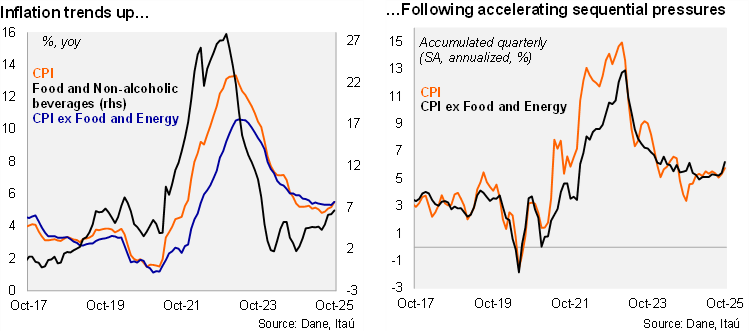

Annual core and headline inflation rebounded again, surprising the market consensus to the upside. Consumer prices rose by 0.18% MoM in October, above the Bloomberg market consensus of 0.14% and our 0.09% call. The main positive contributors in the month were housing and utilities (+0.41%; +13bps), hotels and restaurants (+0.27%; +3bps) and entertainment (+0.8%; +3bps). Meanwhile, food prices dropped 0.35%, subtracting 7bps. Housing and utilities explained most of the upside surprise relative to our forecast (particularly water supply and sewage). Consumer prices excluding food rose by 0.31% MoM (+0.01% one year earlier), while inflation excluding food and energy rose by 0.31% MoM (+0.13% one year ago). On an annual basis, headline inflation increased by 33bps from September to 5.51% in October, while core inflation increased by 19bps to 5.5%. Year-to-date inflation sits at 4.7% (4.4% by October 2024), well above the ceiling of the tolerance range around the central bank’s 3% target.

A widespread acceleration in inflation, with service pressures remaining elevated. Non-durable good inflation (mainly food) came in at 5.2% YoY, increasing by 68bps from the previous month. Meanwhile, energy inflation rose 132bps to 2.9% YoY, amid a low base comparison from last year. Despite the peso’s strengthening, durable goods increased 47 bps from the previous month to 0.6% YoY. Services inflation rose by 10bps to 6.4% (9.51% peak in September 2023). At the margin, we estimate inflation accumulated in the quarter reached 5.8% (SA, annualized, +5.3% in 3Q25). Core inflation rose to 6.2%, from 5.4% in 3Q25 (SA, annualized).

Our take: Our preliminary estimate for November’s monthly inflation, scheduled for release on December 5, ranges between 0.2% and 0.3%, resulting in the annual CPI print falling mildly from the current 5.5%. Significant indexation pressures and a disinflationary process that has progressed slowly in rents and restaurants are leading inflation to stay at above 5% levels. As a result, the bar remains high for any cut in the MP rate in the near term. We forecast the policy rate being unchanged at 9.25% for the rest of the year, while cuts may only resume in the latter part of 2026 if there are signs of relief with regards to inflation and CPI expectations.