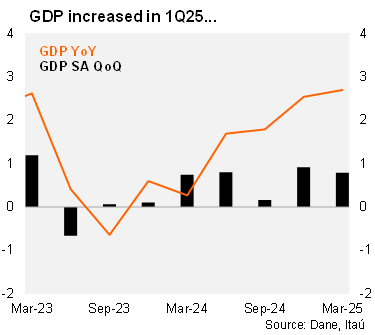

Colombia’s economy grew above expectations in 1Q25. Activity increased 2.7% yoy in 1Q25 (+2.5% yoy in 4Q24; revised up from 2.3%), above BanRep's staff forecast and Bloomberg market consensus (2.5%), as well as our call (2.3%). In annual terms, activity was boosted by entertainment, agriculture, and commerce, while manufacturing showed a mild growth. Even though growth was above consensus, key sectors such as mining and construction continued in negative territory. Sequentially, the economy rose 0.8% (SA) from 4Q24 to 1Q25 (+0.9% previously, revised from +0.6%), primarily lifted by household consumption. However, gross fixed investment fell at the margin, while imports dynamics remained strong.

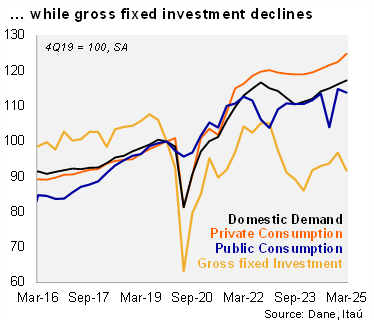

Imports dynamics remain upbeat, signaling the recovery of domestic demand. Gross fixed investment rose 1.8% yoy (+11.8% in 4Q24), due to an increase in machinery and equipment (+12.5% yoy), but dragged by housing (-8.6% yoy). Total consumption increased by 3.8% yoy (+3.2% yoy in 4Q24), lifted by public consumption rise of 4.3% yoy (+4.1% in 4Q24) and private consumption increase of 3.8% (+2.8% in the previous quarter). Exports increased by 2.4% over one year (+1.8% in 4Q24), while imports continued to improve, with an increase of 11.9% (+9.8% in the previous quarter). On the supply side, the natural resource sector rose 3.6% yoy (+4.3% in 4Q24), lifted by agriculture (+7.1% yoy), while mining fell 5.0% yoy. Non-natural resource activity increased by 1.6% (+1.4% in the 4Q24).

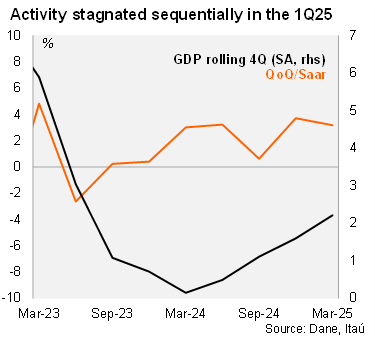

Mixed results at the margin. Activity increased by 3.2% qoq/saar, down from the 3.7% registered in the 4Q24. The seasonal and calendar adjusted series show that gross fixed investment fell 19.4% qoq/saar (+13.6% in the previous quarter). Meanwhile, imports increased by 8.9% qoq/saar (+7.1% in 4Q24). The coincident activity indicator (ISE) fell 0.9% from February to March (SA, +0.3% mom in February). Nevertheless, on an annual basis, the ISE posted an expansion of 4.9% yoy in March, boosted by agriculture (+16.3% yoy), entertainment (+14.7% yoy) and commerce (+5.4% yoy).

Our Take: Activity continues to recover, driven by a rebound in domestic demand. However, key sectors such as mining and construction remain weak. We expect activity to grow 2.0% this year (+1.7% in 2024; +0.7% in 2023), but with an upside bias.