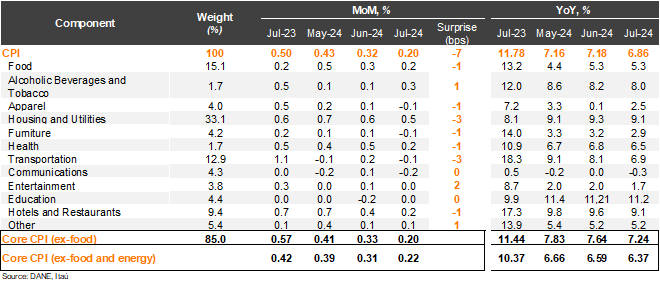

Consumer prices rose by 0.20% from June to July, below the Bloomberg market consensus of 0.28% and our 0.27% call. The main positive contributors in the month were housing and utilities (+0.45% MoM, +14bps), food (+0.21% MoM, +4bps), and hotels and restaurants (+0.22% MoM, 2bps). Nevertheless, housing and utilities underwhelmed our expectation, along with transport, apparel and furniture prices. Consumer prices excluding food rose 0.20% MoM, while inflation excluding food and energy rose by 0.22% MoM (core; 0.42% one year earlier). Overall, annual headline inflation fell by 32bps from June to 6.86%, the lowest level since 1Q22, while core inflation dropped from 6.59% to 6.37% (10.60% peak in April last year).

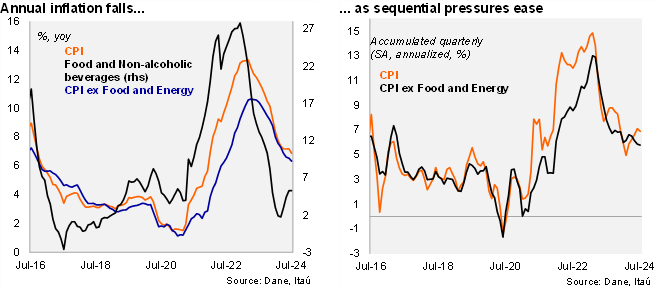

Services disinflation underway, but still only gradually. Non-durable goods inflation (mainly food) came in at 7.30% YoY, dropping by 54 bps from the previous month. Meanwhile, energy inflation fell to 15.99%, a drop of 236bps from June. Durable goods inflation remained in negative territory, falling from -4.78% to -4.94% in July (16.8% peak in January 2023), dragged by soft domestic demand. Services inflation fell 18bps to a still elevated 8.05% (9.51% peak in September). At the margin, we estimate that inflation accumulated in the quarter was 6.9% (SA, annualized; 5.9% in 1Q24). Core inflation moderated to 5.8% from 6.6% in 1Q24 (SA annualized).

Our take: The July inflation print confirms that a high base of comparison, along with soft domestic demand amid the restrictive monetary policy, have supported the disinflationary process. However, inflation expectations remain elevated. Sticky rental price dynamics will also restrict the speed of the disinflation process. Our preliminary estimate for August’s CPI, to be released on September 6, is between 0.2% and 0.3%, resulting in annual inflation falling to 6.5%. We expect a YE24 CPI at 5.6%, with risks tilted to the upside. We envisage the central bank’s Board to cut by another 50bp to 10.25% at the September 30th meeting. However, a swifter easing cycle by the Fed, and falling domestic inflation may encourage greater support within the Board to accelerate the easing pace.